April 23, 2024

From analysis to action: supporting sustainable decisions in home insurance

We were joined by Gamma and AXA to find out how they work with insurers to support sustainable decision-making among policyholders, as well as a demo of the platform in action.

April 19, 2024

Carbon insurance – is 2024 the year of action?

In this month’s issue of Climate Risk, we cover the developments in the carbon insurance markets including multiple new projects and funding rounds.

March 31, 2024

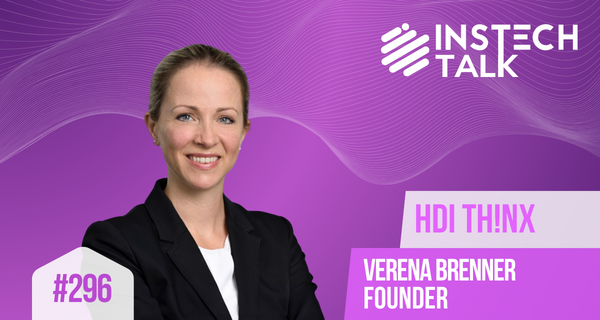

Insurer-led innovation

Matthew Grant spoke to HDI TH!NX 's founder Verena Brenner on developing a startup whilst working in an insurer, and scaling the business into a successful model helping insurers understand their risks better.

March 24, 2024

Managing your flood risk – stories from the frontline

This week, Matthew Grant spoke to Previsico's Dr Avi Baruch and a few of his clients at Zurich and Donaldson Timber.

March 22, 2024

Where will be hit the hardest by climate change?

In this month’s issue of Climate Risk, we cover the which countries will be most at risk of higher property damage losses due to climate change.

March 17, 2024

Groundwater – the hidden predictor of future flood loss

This week, Matthew Grant caught up with Mark Fermor at GeoSmart, a company specializing in flood data analytics in the UK.

February 23, 2024

Building resilience to climate risks

In this month’s issue of Climate Risk, we cover new initiatives for reducing the impact of climate events; including a partnership for severe weather early warnings and investment into companies focusing on climate resiliency.

February 7, 2024

GeoSmart: putting a spotlight on groundwater flooding

InsTech’s Ali Smedley recently sat down with Paul Drury, Director of Product Development at GeoSmart Information, to discuss why insurers should be thinking about groundwater flooding and what the company can do to help.

January 26, 2024

Are storms in the UK changing?

The UK is currently experiencing a series of damaging storms, with winds from Isha reaching over 100mph. Storm Jocelyn has followed close behind, arriving in the UK with 76mph gusts. Are storms in the UK becoming more frequent?

November 28, 2023

Beyond the smoke: Understanding and mitigating wildfire risk

Wildfires are growing in severity and intensity. Since 2013, they have cost the insurance industry over $70 billion. But wildfire has traditionally been thought of as a ‘secondary peril’ – is it due a promotion to ‘primary peril’?

June 23, 2023

Building transparent coverage for hurricane risks

The Florida insurance market has faced numerous challenges in recent years. For insurers to underwrite profitably in Florida, having the right hurricane reinsurance is essential.

David Schmid, Head of Parametric Products at Reask, and Brian Espie, Chief Underwriting Officer at Kettle, join Henry Gale to ...