The reason why this matters is because insurers are not in control of the data they receive. And they exist in a marketplace where there are many, many clients, there are many, many brokers, and there are many insurers. And that means inherently risk data is heterogeneous and it is not standardized. And that’s why you ultimately need technology to understand risk information, interpret it, digitize it, standardize it, turn it into a format that’s unique to your view of risk and then enable decisions off the back of that.

Knowledge Centre

Browse by category:

Videos

‘Orca’ the underwriting platform for the modern underwriting team

Matthew Grant spoke to Bevis Tetlow (CEO) and Viren Kataria (Chief Product Officer) of Imaginera to explore how the company’s underwriting platform, Orca supports reinsurers and speciality insurers.

From analysis to action: supporting sustainable decisions in home insurance

We were joined by Gamma and AXA to find out how they work with insurers to support sustainable decision-making among policyholders, as well as a demo of the platform in action.

Knowledge unlocked: how to use an AI second brain

The insurance industry has a notorious problem with scattered data. We were joined by Christopher Payne, CEO and Co-founder of myReach to discuss how Generative AI is making a new type of knowledge management possible, acting as a second brain for all your knowledge.

Generative AI – from experimentation to implementation

We brought together three speakers who have grappled with AI strategies at insurers and brokers to learn what use cases of GenAI are creating value for them today.

From data to decision: how insurers are using underwriter workbenches in 2024

On 26 March, to coincide with the release of InsTech’s latest report about the underwriting workbench landscape, we hosted a webinar to discuss implementation experiences and how insurers are using underwriter workbenches in 2024.

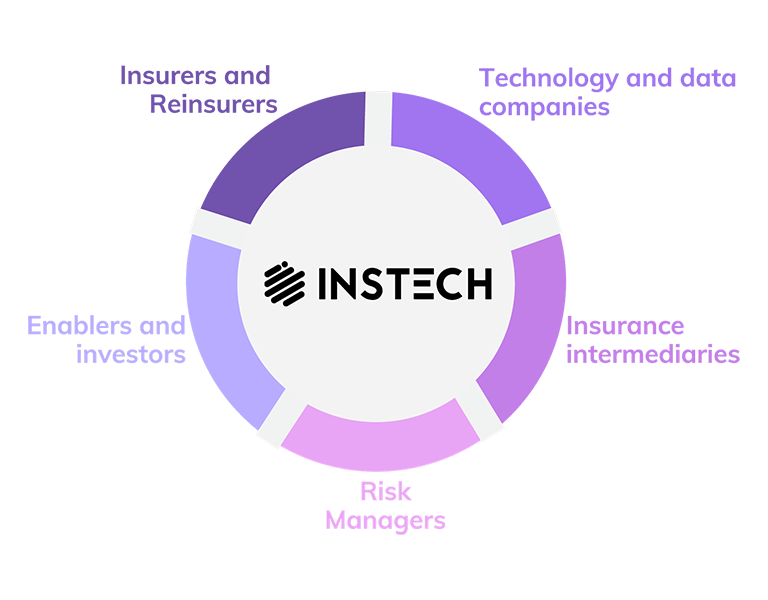

The InsTech Community

Collaboration of the curious

Bringing together those with an interest in risk and insurance, InsTech is a community that connects the insurance ecosystem. Our global network of over 30,000 senior insurance professionals and 150+ corporate members consists of large enterprises, early-stage start-ups and everything in between.

Focused on where change is impacting insurance

At InsTech we care most about where change is impacting insurance today – entering new markets, improving core business processes with technology and responding to emerging risks.

-

There is more data available now than ever before. Understanding the best data to use for underwriting, how to use data for risk management and how to exchange increasingly large amounts of data between parties are key considerations.

-

The technologies that insurance companies use are becoming more interconnected. Insurers need intuitive platforms that streamline their workflows, integrate with varied data sources and benefit from the efficiency gains of new technologies such as generative AI.

-

With climate change increasing the frequency and severity of weather events, understanding risk exposure is becoming more important than ever. Whilst insurers need to report on climate-related risks, they are also exploring new products to support the transition to a greener economy, from carbon to renewables.

-

Data and technology are changing the way that insurers underwrite. Improved catastrophe models and new technology for algorithmic underwriting are helping to make the day-to-day lives of underwriters easier.

-

New technologies promise to make the claims process more efficient, with remote assessment and document ingestion making life easier for adjusters.

-

The insurance value chain is changing. More business than ever is being underwritten by MGAs. Some consumer insurance is increasingly ‘embedded’ into other products. The whole market continues to search for efficient ways to match capital to risk and close the insurance protection gap.

-

Parametric insurance is enabling coverage for risks that were previously difficult or impossible to insure. With pay-outs based on event triggers rather than loss assessments, organisations are increasingly turning to parametric to fill gaps in catastrophe cover or protect against emerging risks.

Deliver insurance better

Our intelligence and insights enables the community to make informed decisions on how to deliver insurance better.

Join the InsTech Community

Create a free account for quicker access to events, reports and more.

Work with InsTech

Discover how InsTech Corporate Membership can benefit your team, with tailored membership to match your business goals. Explore the full benefits now:

Trusted by

About

In 2015 we could see the opportunities for change in insurance. Back then we had more questions than answers. How can insurance be delivered better than it is now? What are the issues that most need to be addressed? What data sources and toolsets lie out there that will help do that? What does the future of insurance look like?

So we founded InsTech. A community of like-minded people who could share their discoveries, visions, solutions and ideas and meet with others doing the same. It’s grown to over 30,000 people who meet, read, listen to or watch us and our members to learn how to deliver insurance better.

With so many ways to get involved, from newsletters, podcasts, events, reports and more, join us to collaborate, share ideas and make new connections.