Climate Risk is InsTech’s monthly newsletter dedicated to sustainability and climate-related insurance news.

Which countries will be hit the hardest by climate change?

Climate change is affecting locations across the world in different ways. Severe weather events are increasing, but the impacts of these are not felt equally across the globe.

When it comes to property damage, more losses are likely to occur in countries where heightened natural hazards converge with high levels of economic exposure, creating a perfect storm of vulnerability.

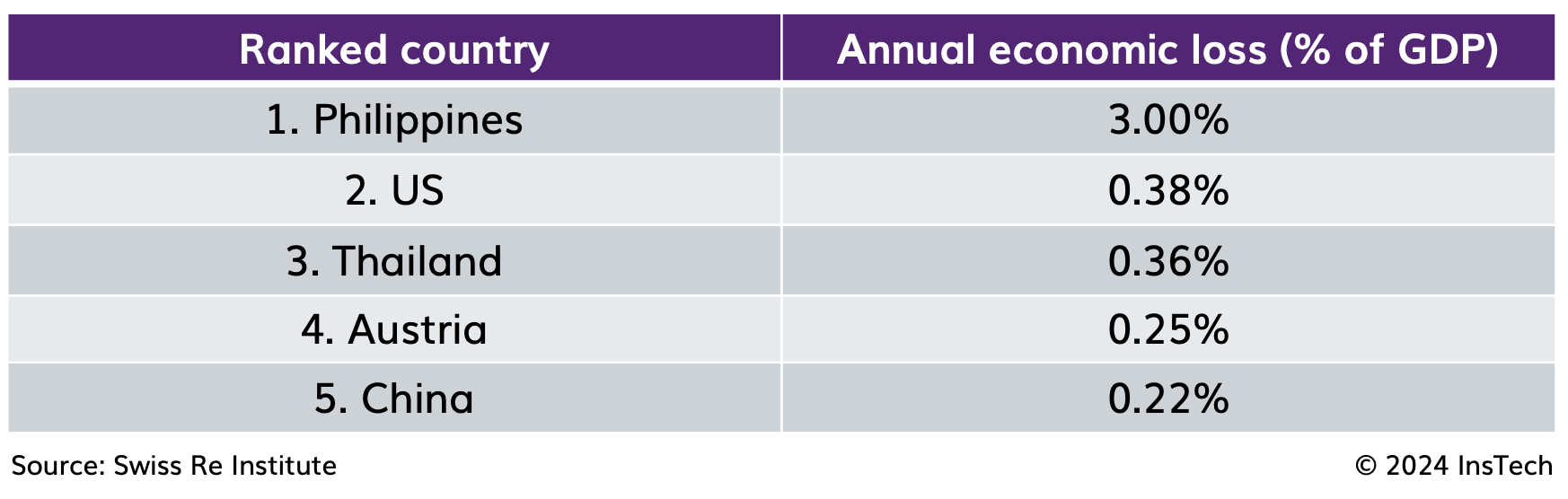

Swiss Re Institute has ranked the 36 countries most at risk of higher property damage losses due to climate change. It explored the potential impacts from four major weather perils (floods, tropical cyclones, winter storms and severe convective storms).

The Philippines stands as the most affected, with probabilistic annual economic losses amounting to 3% of its GDP. The US is ranked second – despite experiencing the highest absolute economic losses from weather events globally (totalling USD 97 billion), as it is a smaller percentage of its GDP. This is also due to a moderate probability of hazard intensification, compared to the Philippines’ high probability of worsening hazards. The UK is ranked at 20.

As global temperatures rise and severe weather events increase, climate adaption will be key. Support from both the public and private sectors to help close the protection gap, particularly in countries like the Philippines, will play an important role in building resilience for communities and businesses.

Networking Event: Catastrophe camaraderie – convening the modelling minds, 27th March

Catastrophe models have provided insurers with data and analytics to price and manage risk for over 30 years. The community of model buyers, users and reviewers is one of the best examples of collaboration for the benefit of their clients and their organisations. InsTech is delighted to be running a series of quarterly ‘meet-ups’ to provide a chance to meet old friends and make new ones. Our first event will be held on 27th March in collaboration with CoreLogic.

Networking Event: Sustainability in insurance, 2nd May

While every insurance company is at a different stage on its sustainability journey, a lot can be learned from sharing experiences and knowledge. On 2nd May we are hosting an event to bring together the insurance leaders working on ESG and sustainability. It will be an insurer-only evening, with limited spaces available. If you work in a sustainability role at an insurer or broker and are interested in attending, email us at [email protected].

Quotech: Underwriting technology built by underwriters

We recently sat down with Guillaume Bonnissent, Founder and CEO at Quotech, to discuss why he decided to build the Quotech platform, how the company works with new data sources and its latest exposure management module.

Arturo: Protecting against assuming unsustainable risk

A lot has developed in property intelligence since we last spoke to Arturo on the podcast. Matthew Grant caught up with CEO Marty Smuin about how generative AI is adding a new dimension to property risk assessment.

Geosmart: Groundwater – the hidden predictor of future flood loss

Groundwater flooding poses a great risk to properties in the UK but remains much less widely modelled than other types of flooding. Learn more about this hidden risk in podcast episode 294 with Mark Fermor from GeoSmart, a company specialising in flood data analytics in the UK.

PwC: ESG – from ambition to action

PwC’s Chris Temple and Christine Brogan join Matthew Grant to discuss transformation in insurance, specifically steering organisations towards achieving their ESG goals. Key talking points include measuring baseline carbon outputs and the main sustainability priorities organisations need to be thinking about.

Managing weather-related business volatility

Changes in the weather can significantly disrupt demand and operations for companies in sectors such as energy, construction and events, even if they cause little or no physical damage. This article explores how organisations are choosing parametric insurance to manage their exposures to weather variability.

In the news…

Texas wildfires put over 1,500 homes at risk

The fires burned over one million acres, making it the largest wildfire event in Texas history. It has now been contained after three weeks of burning, which started at the end of February. Around 500 properties were destroyed. But this loss could have been higher – according to CoreLogic, 1,544 single-family residential properties with a combined reconstruction value of $356 million fell within the wildfire perimeter. An electric utility company has acknowledged that its facilities are likely to have been involved in igniting one of the fires.

Reask and AXA Climate partner for parametric windstorm insurance

Climate risk modeller Reask is collaborating with AXA Climate to provide parametric insurance solutions across the world. The products will pay out based on Reask’s location-level wind speed data following the landfall of tropical cyclones.

California to allow expanded use of catastrophe models for wildfire and flood

Currently, the California Department of Insurance allows the use of catastrophe models for earthquake losses and fire following earthquakes. The proposed regulation expands the allowable use of catastrophe models to include wildfire, terrorism and flood for residential and commercial lines of business. The aim of this regulation is to develop a more sustainable view of insurance rates in the state.

CFC launches carbon delivery insurance

The specialist insurer’s new product covers both the physical and political risks faced by businesses buying voluntary carbon credits on a forward basis (where the credits are delivered at a future date). CFC’s underwriting model rates the carbon projects, with same day quoting and binding currently available for a buyer purchasing from one of over 300 carbon projects.

Floodbase to launch parametric insurance for farmers in Mozambique and Malawi

Floodbase has been awarded a US government grant to launch parametric flood insurance programmes in Mozambique and Malawi, with support from African Risk Capacity Limited and Global Parametrics (now part of CelsiusPro). Payouts will be triggered using a combination of satellite observations and machine learning, enabling smallholder farmers to be paid within days of a flood.

Howden and Aviva partner for solar subscription start-up insurance

The bespoke insurance product has been created for Sunsave, which offers UK homeowners solar panels with no upfront cost. Sunsave’s customers commit to a regular payment plan for the solar batteries and panels. The newly created insurance policy covers customer subscription fees in the event of solar panel damage.

Beazley Digital launches ESG assessment tool for small businesses

The ‘Better Business Hub’ offers a free self-assessment to help SMEs understand where they are on their responsible business journey. The tool aims to help businesses identify what they could be doing to make their organisation more sustainable across all three components of ESG.

JBA highlights the need for flood risk assessment across investment portfolios

JBA Risk Management warns that investors’ portfolios could be at risk due to inadequate flood data and climate intelligence. Organisations around the world are now having to meet new annual reporting standards under the International Sustainability Standards Board’s (ISSB). Read more in this article to learn how JBA’s data can support investment and divestment decisions.

Navigating flood risk – a primer for actuaries

Flood modeller Fathom, which was recently acquired by Swiss Re, is releasing a whitepaper aimed at actuaries. It will analyse the value of combining traditional modelling techniques with new methods and discuss how actuaries can benefit from integrating these modelling approaches into exposure management.

Previsico to host flood risk innovation event a Lloyd’s

The event will bring together water companies, insurers and brokers to discuss the use of technology for managing flood risk. There will be speakers from companies including AXA XL and Descartes – you can register to attend on 8th May here.