The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… parametric triggers for governments’ disaster risk financing

Governments across the world are increasingly using parametric triggers to manage their disaster risk. In this week’s Parametric Post, Nicaragua, Trinidad and Tobago and Antigua and Barbuda receive pay-outs, while Barbados embeds parametric triggers in the issuance of a sovereign bond.

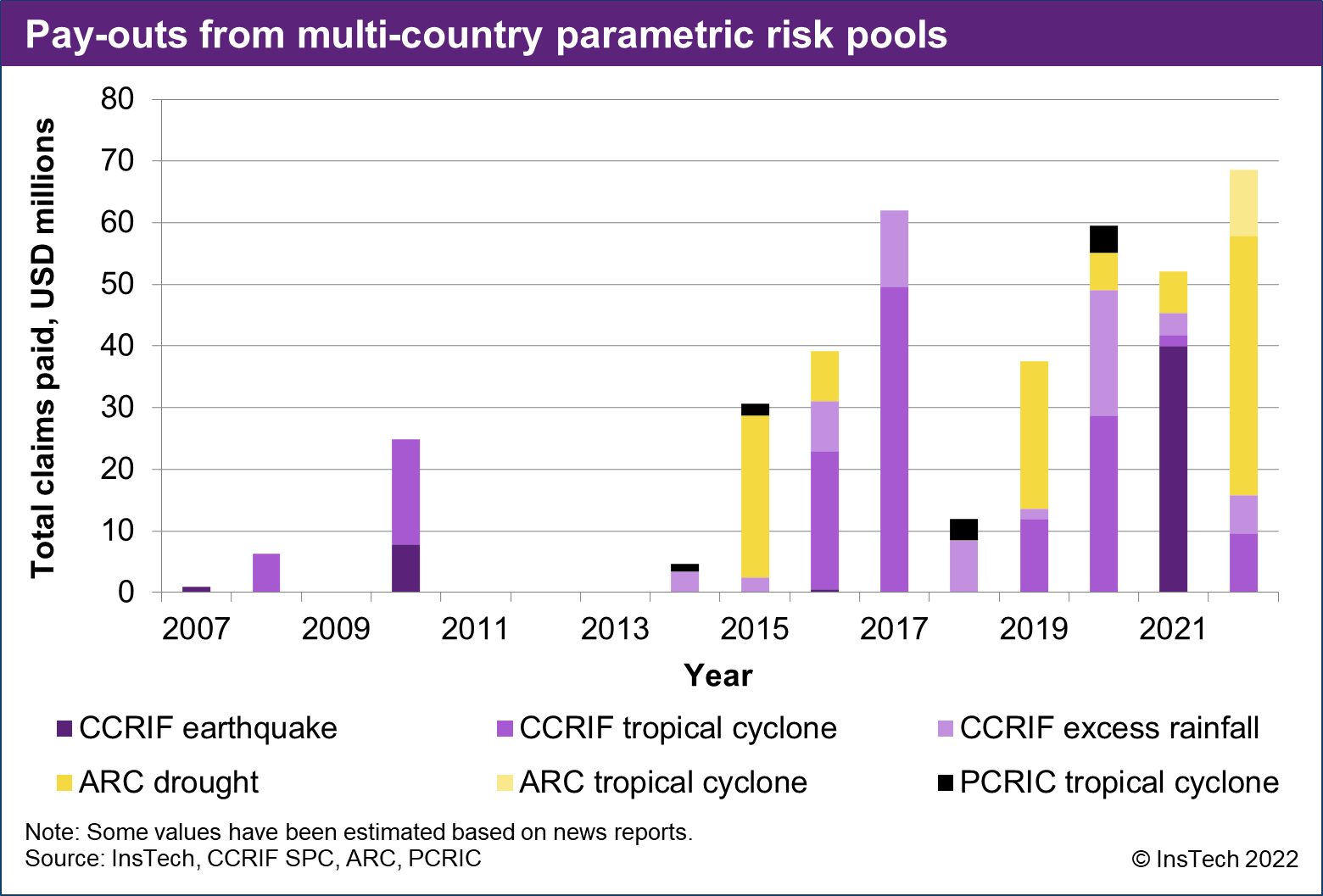

The Caribbean Catastrophe Risk Insurance Facility (CCRIF) became the first multi-country risk pool in the world when it was formed in 2007 to offer parametric catastrophe insurance to Caribbean governments. Since then, CCRIF has expanded to Central America, and other multi-country parametric risk pools have been formed: PCRIC (Pacific Catastrophe Risk Insurance Company) in the Pacific, ARC (African Risk Capacity) in Africa and SEADRIF (Southeast Asia Disaster Risk Insurance Facility) in Southeast Asia. Today 39 governments, as well as a number of public utilities and humanitarian organisations, have parametric coverage from one of these pools.

2022 is a record year for parametric pay-outs from multi-country risk pools, with nearly $70 million USD paid in claims. The increase over time partially reflects the growing amount of risk that countries are transferring to these pools through parametric insurance. CCRIF’s members increased their coverage by 10% in 2022, purchasing $1.2 billion USD in coverage limit. ARC wrote $180 million USD in coverage limit in 2021, a 55% increase from 2020. Meanwhile, risk pools are making new parametric products available for governments, with ARC and PCRIC planning to launch flood and drought products respectively in the coming months.

As pay-outs prove the effectiveness of parametric insurance for disaster risk management, governments are increasing their confidence in parametric structures. Countries vulnerable to natural disasters are increasing their coverage limits, buying parametric insurance for the first time or exploring new ways to use parametric triggers. In Issue 17, Belize used a parametric hurricane trigger in a sovereign debt refinancing transaction, while in this issue, Barbados adds parametric triggers to the issuance of a sovereign bond.

In the news…

800 Raincoat policies triggered by Hurricane Fiona in Puerto Rico

US • Hurricane • InsTech podcast

After Hurricane Fiona made landfall in Puerto Rico in September 2021, more than 800 individuals with parametric policies from Raincoat received a pay-out. Raincoat designs and provides software for consumer parametric products and the company raised $4.5 million USD seed funding earlier this year. On InsTech podcast episode 183, Co-founder and CEO Jonathan Gonzalez explains how his personal experience of Hurricane Maria in 2017 inspired him to start the company.

Chaucer provides capacity to K2 Parametric

US • Earthquake • Hurricane

Insurer Chaucer has announced a capacity partnership with parametric insurance MGA K2 Parametric. K2 Parametric, founded in 2021 as part of K2 Insurance Services, underwrites parametric hurricane and earthquake insurance in the US, focusing on corporate and public entity clients. The partnership with Chaucer will allow K2 Parametric to offer coverage limits of up to $15 million USD.

Swiss Re announces ‘Parametric Toolbox’ with China pilot

China • Typhoon • Weather

Swiss Re has developed what it calls a ‘Parametric Costing Toolbox’, intended to make the process of structuring parametric insurance and reinsurance products for its clients faster. The platform uses Swiss Re’s catastrophe models to choose a suitable index and calculate the probability of a pay-out being triggered in a given period. It has been used to design parametric typhoon and rainfall insurance products for Swiss Re’s clients in mainland China since earlier in 2022.

Tractable to use computer vision for Fiji hybrid microinsurance

Fiji • Cyclone • Flood

The United Nations Capital Development Fund (UNCDF) has partnered with Tractable to provide fast claims payments to customers of hybrid parametric microinsurance products in Fiji. Tractable creates damage estimates from photographs of cars or property. After a flood or cyclone, policyholders of the UNCDF’s microinsurance products will receive a pay-out automatically if parametric triggers are met. Tractable is working with the UNCDF to develop an application so that if the triggers are not met, policyholders could still receive a pay-out within days if they upload photographs of damaged property which are verified by Tractable.

$15.2m in CCRIF parametric pay-outs triggered in October

Caribbean • Central America • Hurricane

The Caribbean Catastrophe Risk Insurance Facility (CCRIF), a multi-country risk pool, has announced four pay-outs made in October 2022. Nicaragua received $8.9 million USD after Hurricane Julia made landfall on 9 October. Trinidad and Tobago received two separate pay-outs totalling $5.84 million USD after a heavy rainfall event caused flooding. Antigua and Barbuda received $0.4 million USD following rains caused by Hurricane Fiona.

Airmic: 4% of surveyed risk managers have purchased parametric

UK • Climate

UK-based risk management association Airmic surveyed its members in September 2022 about climate risk and parametric insurance. It has now published the results, which show that flood and extreme high temperatures were risk managers’ top natural peril risks. 4% of those surveyed had purchased parametric insurance before, while 64% had considered but not purchased parametric products.

Barbados issues sovereign bond with parametric triggers

Barbados • Hurricane • Earthquake

Barbados has issued a sovereign bond including parametric catastrophe triggers. The parametric triggers allow Barbados to defer payments to its bondholders after a tropical cyclone, earthquake or heavy rainfall event of sufficient intensity. CCRIF is acting as the calculation agent, measuring whether the parametric triggers have been met.

Vortex launches automated quote-and-bind portal

US • Weather

Vortex Weather Insurance, which offers parametric weather insurance for event organisers, has launched a portal for brokers and customers to purchase cover online. Users can input the location, time and weather event they want to be covered, along with the desired limit, and quotes are generated automatically. Vortex’s policies are underwritten by insurer Mitsui Sumitomo.

New weather insurance product for rice farmers in Vietnam

Vietnam • Agriculture • Weather

Singapore-based embedded insurance start-up Igloo is now offering a blockchain-based weather index insurance product for rice farmers in Vietnam. Pay-outs are triggered by rainfall data from the Vietnam Meteorological and Hydrological Administration. Vietnamese insurer PVI Insurance provides insurance capacity and SCOR is providing reinsurance capacity.

Parametric pilot launches in Fiji ahead of cyclone season

Fiji • Cyclone

New Zealand-based insurer Tower Insurance has launched a parametric cyclone insurance product for individuals in Fiji, in partnership with the United Nations Capital Development Fund. The product is being piloted in two villages for the 2022/23 cyclone season. Coverage limits of between $1000 and $3000 FJD (between $440 and $1315 USD) are available, with premiums between $75 and $285 FJD (between $33 and $125 USD).

Colombian index insurance programme pays out $3m in 2022

Colombia • Agriculture • Weather

6,745 smallholder coffee farmers in Colombia received parametric pay-outs in 2022, with claims totalling $3 million USD. MGA Blue Marble insures Nespresso coffee farmers against excess and lack of rain with insurance capacity from Seguros Bolívar.

Find out what you’ve missed…

Issue 36 – Climate change impact on parametric portfolios

Issue 35 – Parametric protection at the point of worry

Issue 34 – New ways to combine parametric and indemnity covers

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.