The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… parametric opportunities in semiconductor supply chains

In recent years, parametric insurance has seen the most traction where traditional insurance falls short. Semiconductor supply chains are one such area where there are gaps in coverage and opportunities for innovation, according to a recent report from Lloyd’s of London and WTW.

Semiconductors are critical components of many electronic devices including smartphones, computers, household appliances and cars. A global shortage of semiconductor devices that began in 2020 demonstrated how fortuitous events can disrupt supply chains with widespread consequences and long-term effects.

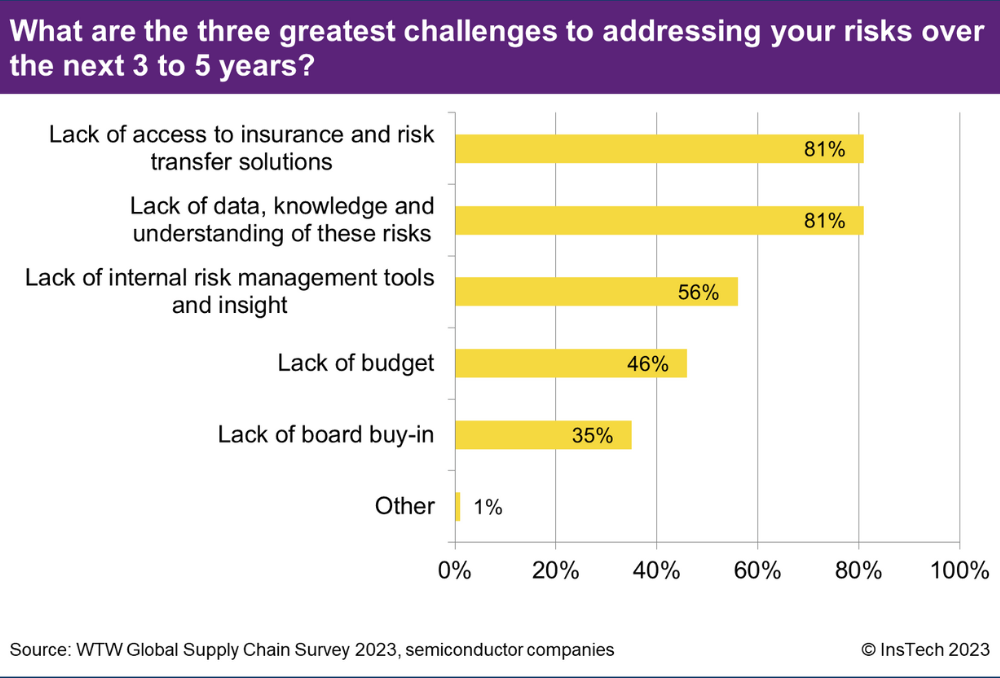

WTW’s recent survey found that 52% of semiconductor companies consider insurance for supply chain risks mission critical, with a further 36% believing some cover is necessary. Whilst semiconductor companies displayed “a good degree of knowledge of the insurance covers available”, according to the report, 81% said a lack of insurance solutions was among the greatest challenges to addressing their supply chain risks. The semiconductor industry is looking to buy insurance but has not found suitable products for all the risks it faces.

Parametric insurance is already used by some semiconductor companies to cover events that disrupt their supply chain. The Lloyd’s/WTW report refers to a company purchasing parametric cover for earthquakes in or around Taiwan that could affect their main supplier. Several other risks, such as power outages and water shortages, that semiconductor companies face in their supply chain and want coverage for, present opportunities for insurers to build new parametric insurance products.

Fredrik Motzfeldt, GB Regional Industry Leader for Technology, Media & Telecommunications at WTW, believes “parametric solutions will have a greater role to play in the future – due to the big financial exposures in the supply chain and increasing data as the semiconductor industry continues their efforts to map the value chain. At the moment, parametric insurance is used selectively by the semiconductor industry to cover for example earthquake. There is potential for new parametric insurance use by the industry, and we believe this will materialise over the coming years.”

According to the WTW survey, most semiconductor companies lack sufficient supply chain risk data and the tools and insight they need to manage their risks. As the semiconductor and insurance industries work together to solve data challenges, greater access to reliable supply chain data could create opportunities to build indices for new parametric insurance products.

This week’s Parametric Post also features insights about supply chains in other industries, with Otonomi and Greenlight Re launching cargo delay insurance and a Descartes Underwriting case study of river-level insurance for the steel industry.

Cerchia: new sources of capital to transfer emerging risks

Catastrophe bonds • InsTech interview

Cerchia’s Michael Rey and Fabian Buchmann discuss challenges in the insurance-linked securities market and the use of parametric triggers to transfer emerging risks to capital markets. Cerchia is creating a digital marketplace for parametric risk transfer to capital markets.

Understanding and managing natural hazards

InsTech report

Accurate hazard modelling is essential for companies underwriting parametric insurance to achieve a profitable and diversified portfolio. InsTech’s latest report covers innovations in natural hazard modelling, profiling companies creating and providing proprietary hazard models and data for insurance.

In the news…

Parametric policy protects Djibouti against droughts and floods

Djibouti • Drought • Flood

The government of Djibouti is now protected by a five-year parametric policy from the African Risk Capacity (ARC), a multi-country risk pool, protecting it against droughts and excess rainfall. Insurer and MGA Descartes Underwriting contributed its technical expertise and modelling capabilities to design the policy. Whilst the drought coverage uses a custom-designed index involving soil moisture, rainfall seasons and pastoral migration patterns across the country, the excess rainfall trigger is focused on Djibouti City, which is highly exposed to flash flooding. The World Bank and the Global Risk Financing Facility provided $2 million USD of financing for the policy.

Otonomi partners with Greenlight Re on cargo cover

Supply chain

Parametric cargo delay insurance start-up Otonomi has announced a partnership with reinsurer Greenlight Re. Greenlight Innovation Syndicate 3456 will offer a parametric cargo insurance programme using Otonomi’s platform. Greenlight Re Innovations previously invested in Otonomi’s $3.4 million USD seed funding round.

Two hurricanes trigger Swiss Re pay-outs to energy provider

US • Hurricane • Energy

Florida-based energy company Automated Petroleum has purchased parametric hurricane insurance from Swiss Re since 2021. In 2022, its policy was triggered by both Hurricane Ian in September and Hurricane Nicole in November. In each case, Automated Petroleum received a pay-out within 14 days. RMS HWind provided wind speed data for the trigger.

Mozambique covered by $35m parametric cyclone policy

Mozambique • Cyclone

The government of Mozambique, through its National Institute of Disaster Management, has purchased a parametric cyclone reinsurance policy, supported by the World Bank’s Global Facility for Disaster Reduction and Recovery. The policy, backed by reinsurer Africa Specialty Risks, pays out up to $35 million USD to Mozambique’s state insurer when wind speed and precipitation triggers are met. CelsiusPro designed the policy’s risk model and is acting as the calculation agent, while Pula structured the policy with the World Bank.

Reask: Hurricane Ian wind speeds and parametric insurance

US • Hurricane

David Schmid, Head of Parametric Products at Reask, explains how the unusual distribution of wind speeds in Hurricane Ian could have affected parametric pay-outs. While for most tropical cyclones in the northern hemisphere, the highest wind speeds occur on the right side of the storm track, Hurricane Ian’s highest wind speeds were on the left. Reask provides wind hazard intensity metrics used to trigger parametric insurance products.

Descartes: insurance for river-dependent industries

Europe • Supply chain • Energy

Parametric insurance using water levels in rivers as an index can protect supply chains and hydropower plants affected by river level volatility. Descartes Underwriting’s case study explains how a steel supplier whose regular operations were halted by low water levels in the Rhine in 2022 has chosen parametric insurance to cover future business interruption losses.

AXA XL backs Intangic MGA’s new cyber parametric product

UK • Cyber

A new parametric cyber insurance product has been launched by Intangic MGA, with capacity from insurer AXA XL. Pay-outs are triggered when an index measuring the volume of malicious cyber activity targeted at the company reaches a certain threshold and the value of the company drops. Skyline Partners helped design the product and is acting as the calculation agent. The policy is available to large public corporations headquartered in the UK, with limits of up to £12,500 GBP.

Chile secures $630m quake cover from cat bond and swaps

Chile • Earthquake • Catastrophe bond

Chile now has $630 million USD of earthquake protection in a parametric catastrophe bond and catastrophe swap transaction executed by the World Bank. The parametric catastrophe bond transfers $350 million USD of Chile’s earthquake risk to insurance-linked securities investors. If the trigger, involving earthquake location and magnitude, is met, the government of Chile receives a pay-out. Catastrophe swaps allow organisations to exchange one risk for another (as an alternative to purchasing protection against them). For example, an insurer with many policyholders in Florida may use a catastrophe swap with a European insurer to mitigate the risk to their portfolio of a severe hurricane in the US. These World Bank catastrophe swaps mean that $280 million of Chile’s earthquake risk is taken on by reinsurers and investors, some of whose other risk is transferred in turn to the government of Chile. Swiss Re Capital Markets, Aon Securities and GC Securities are joint structuring agents for the transaction, and Verisk Extreme Event Solutions (AIR Worldwide) is the calculation agent.

Cyclone Freddy triggers $1.2m pay-out to Madagascar

Madagascar • Cyclone

The African Risk Capacity (ARC) will pay $1.2 million USD to the government of Madagascar after Cyclone Freddy triggered its parametric tropical cyclone insurance policy. More than 2 million people in Madagascar were exposed to the effects of the cyclone, according to ARC. Madagascar’s tropical cyclone policy previously paid out $10.7 million USD in 2022 after Cyclone Batsirai.

AXA Climate launches parametric tornado insurance

US • Tornado

AXA Climate, part of the AXA Group specialising in parametric insurance, has launched a parametric tornado insurance product in the US. The policy pays out based on tornado intensity as measured by the Enhanced Fujita (EF) scale. The US National Weather Service publishes EF ratings within a few days of a tornado. AXA Climate says the product is targeted at agriculture, manufacturing, energy, construction, hospitality and other industries.

$45,000 in pay-outs triggered to Kenyan farmers

Kenya • Agriculture • Drought

Smallholder farmers in western Kenya received parametric pay-outs totalling nearly 6 million KES ($45,000 USD) from insurer APA Insurance after droughts reduced yields. The farmers were covered by an area yield index insurance product designed by technology company Pula and distributed by agritech Apollo Agriculture. Area yield index insurance protects farmers against reduced crop yield by measuring a geographical area’s average yield for a season against previous seasons. Pay-outs are triggered if the reduction in yield exceeds a predefined threshold.

Find out what you’ve missed…

Issue 44 – Building momentum for parametric flood insurance

Issue 43 – Covering business interruption losses with parametric insurance

Issue 42 – Parametric protection for gig workers

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.