The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… covering business interruption losses with parametric insurance

Parametric insurance has been most widely used to cover the risks that are hardest to cover with indemnity-based insurance. One example is business interruption losses. Traditional business interruption insurance only covers losses or expenses as a result of property damage, such as if a shop has been flooded and needs to close for repairs. If extreme weather does not damage a business’ property but prevents customers from visiting, this ‘non-damage business interruption’ (NDBI) loss may not be covered. With parametric insurance, pay-outs are based on an index rather than an assessment of loss, so a well-structured parametric policy can respond quickly to non-damage business interruption events.

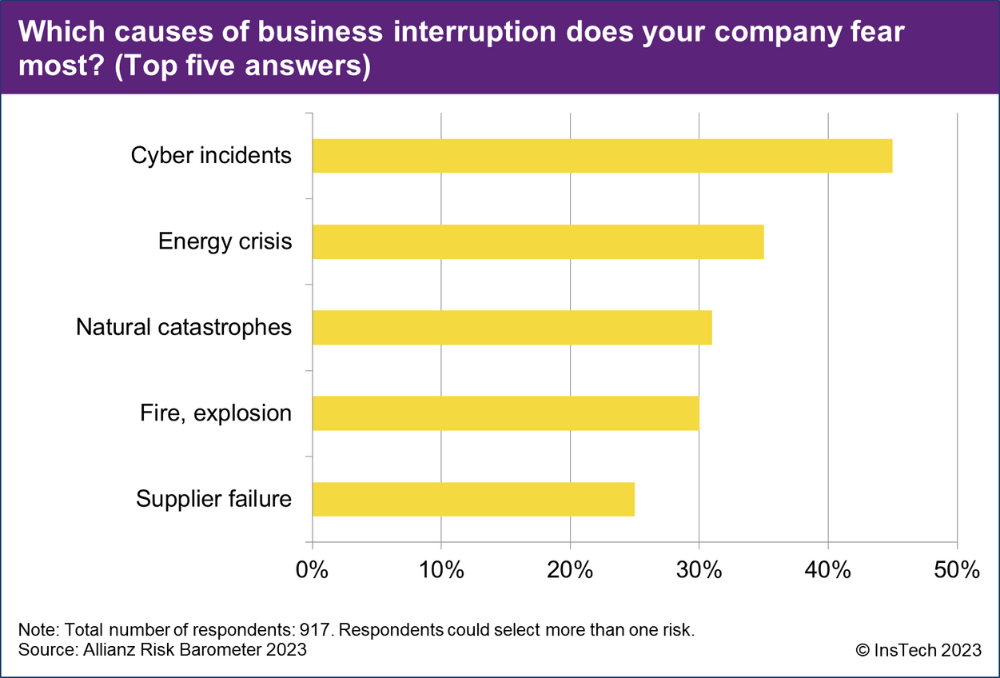

According to Allianz’s Risk Barometer 2023 survey, business interruption is the second most important global business risk for 2023; it has been first or second in Allianz’s ranking every year since 2013. Companies are most worried about cyber incidents, the energy crisis and natural catastrophes interrupting their business. Although these may cause physical losses, they can also cause interruption losses even without physical damage.

It is a long-term trend that traditional business interruption insurance options do not always provide the certainty that businesses need, but the requirements for coverage vary greatly between businesses. The results of InsTech’s 2023 survey showed that supply chain and NDBI was the area where insurers perceived the greatest lack of technology provision. We expect parametric products to use a growing variety of indices and triggers, from weather parameters and terrorist events to transactional data and shipment delays, to address these needs.

Insurer and MGA Descartes Underwriting is among the companies providing parametric products for a range of climate and catastrophic risks. Policies can be structured to be triggered by local extreme weather that affects business activity or even to pay out when a natural catastrophe on the other side of the world disrupts a company’s supply chain.

As well as weather and natural catastrophes, parametric triggers have been used for other NDBI events. New Paradigm Underwriters provides parametric coverage against terrorist events. Otonomi is launching parametric cargo delay insurance to cover losses from supply chain disruption. In a recent InsTech interview, OTT Risk explained how it can cover losses from social unrest with parametric insurance.

In this week’s Parametric Post, Mastercard unveils its Business Continuity Indicator, a tool that uses insights from Mastercard’s transactional data to provide an indication of business interruption. The Business Continuity Indicator compares expected spend with actual spend across sectors and regions. A parametric insurance policy using the Business Continuity Indicator as an index could trigger pay-outs to businesses automatically when there is a pattern of reduced spending activity.

Mastercard: payment-led parametric insurance

Business interruption

Alice Glenister, Director, Insurance at Mastercard, explains how Mastercard’s new Business Continuity Indicator works in our recent interview. The discussion covers NDBI, the importance of payments in parametric insurance and Mastercard’s initiative to build the resiliency of cities with parametric insurance.

In the news…

New Paradigm’s TerrorismPM to cover loss of income

US • Business interruption • Terrorism

MGA New Paradigm Underwriters shares more information on TerrorismPM, its parametric terrorism insurance product. The policy can be structured to pay out when terrorist events occur within a radius of an insured location, or at other key locations where attacks would cause a business interruption loss, such as an airport or power station. New Paradigm is providing limits of up to $50 million USD.

Understanding geographic data for parametric insurance

Agriculture

When covering farms or forests against extreme weather with parametric insurance, insurers need sufficient location information to understand the area’s weather and climate risks. Insurer and MGA Descartes Underwriting has published a fact sheet for farmers and brokers explaining what Global Positioning Systems (GPS) and Geographic Information Systems (GIS) are and how to create shape files, the digitised maps used by insurers when underwriting large fields or properties.

Swiss Re’s guide to parametric insurance eBook

Earthquake • Hurricane

Insurer Swiss Re Corporate Solutions has released a ‘comprehensive guide to parametric insurance’ eBook. As well as information on the different parametric products and structures available, the eBook includes case studies of Japanese earthquake and Caribbean hurricane coverage. It also contains claims testimonials from three Swiss Re customers and brokers.

UNCDF partners with Howden on Pacific parametric insurance

Pacific • Weather

The United Nations Capital Development Fund (UNCDF) has partnered with broker Howden on UNCDF’s Pacific Insurance and Climate Adaptation Programme (PICAP). PICAP has introduced parametric microinsurance products in Fiji, Vanuatu and Tonga during 2021 and 2022, with SCOR providing reinsurance capacity. Howden is providing premium subsidy support.

1,430 pay-outs triggered in IDF’s Mexico parametric pilot

Mexico • Agriculture • Weather

The Insurance Development Forum (IDF), a public-private partnership led by the insurance industry to build the resilience of vulnerable populations, has published its annual report for 2022. The report includes a case study of the IDF’s experience with a parametric insurance pilot for smallholder farmers in Mexico, involving technology provider Raincoat, broker Guy Carpenter and (re)insurers Swiss Re, Munich Re, AXA Climate and Agroasemex. The pilot made pay-outs to 1,430 farmers in 2022 and the IDF aims to roll out the parametric product to more than 250,000 farmers in 2023.

Chile seeks $150m parametric earthquake catastrophe bond

Chile • Earthquake

The International Bank for Reconstruction and Development, the lending arm of the World Bank, is issuing a $150 million USD catastrophe bond on behalf of the government of Chile. The catastrophe bond will protect against earthquake and tsunami risk using a parametric trigger involving quake depth, magnitude and location. Swiss Re Capital Markets and Aon Securities are joint structuring agents, and Verisk Extreme Event Solutions (AIR Worldwide) is the calculation agent.

$15.4m in drought pay-outs to World Food Programme

Africa • Drought

The African Risk Capacity (ARC), a multi-country risk pool, has paid $15.4 million USD to the United Nations World Food Programme (WFP) to support 490,000 people in Burkina Faso, Gambia and Mali affected by drought in 2022. WFP purchases parametric insurance policies from the ARC and other insurers so that pay-outs can fund aid. Droughts in 2022 triggered pay-outs of $7.2 million USD for Burkina Faso, $187,600 USD for Gambia and $8 million USD for Mali.

Find out what you’ve missed…

Issue 42 – Parametric protection for gig workers

Issue 41 – Growing broker involvement in parametric

Issue 40 – Parametric insurance for infectious disease outbreaks

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.