The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… parametric protection for gig workers

Parametric insurance is increasingly used as a tool to build financial resilience. A parametric pay-out can provide the fast liquidity needed after a shock event to rebuild, recover or just carry on. Whilst historically it has been a tool used primarily by corporates, insurers and governments, the sharing economy could offer an opportunity to provide these benefits to individuals.

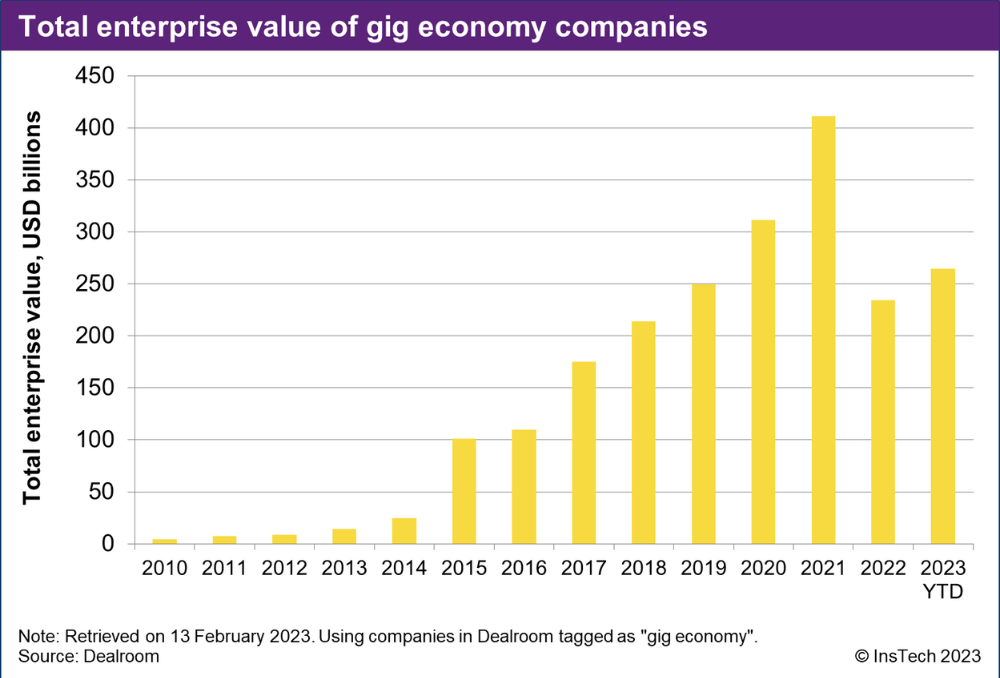

Although definitions and categorisations vary, the sharing economy or gig economy generally involves individuals earning profit by renting out possessions or offering labour through a marketplace-style platform. Uber, Airbnb and Deliveroo are examples of thousands of sharing economy platforms worldwide. Gig economy companies are collectively valued at over $250 billion USD today, according to Dealroom. Despite a recent dip in valuations, the industry is valued more than 60 times what it was in 2010.

Whilst the sharing economy has grown quickly, insurance options have not kept up. In 2018, Lloyd’s of London and Deloitte found that across the US, UK, China, Germany, France and the UAE, approximately 500 million people had shared assets or services to earn a profit in the previous three years. Of these, only 57% had some form of insurance cover for participating in the sharing economy.

While gig workers may buy insurance for their possessions and vehicles, there are fewer options to cover the risk of lost income when extreme weather, a pandemic or another event causes a sudden drop in demand. Parametric insurance solutions can be designed to respond to these non-damage business interruption losses.

In this week’s Parametric Post, MGA OTT Risk announces its partnership with Apollo ibott Syndicate 1971 at Lloyd’s, to offer parametric revenue protection insurance to the users of sharing economy platforms. Chris Moore, Head of Apollo ibott, observes that an increasing number of platforms are looking for solutions like this to protect their users’ incomes.

Parametric insurance in practice requires a strong customer need and a trusted distributor. Many gig workers are not adequately covered by insurance and may not have the resources to absorb shock drops in income. The sharing economy platform is a trusted party they already rely on for their income. If platforms are looking to build their users’ financial resilience, parametric insurance should have a role to play.

Managing combined tropical cyclone and flood risk today

Cyclone • Flood • InsTech article

In November 2022, modelling companies Reask and Fathom co-hosted an InsTech event which reviewed how to understand and manage the key drivers of climate change in cyclones and floods. Reask and Fathom both provide models and data for parametric insurance transactions. To understand how insurers are incorporating future climate risk into underwriting and portfolio management, as well as views on the future of climate analytics and data from industry experts, you can read our report summarising what was discussed.

In the news…

OTT Risk partners with Apollo ibott on sharing economy

Business interruption

MGA OTT Risk’s partnership with Apollo ibott Syndicate 1971 provides parametric protection for peer-to-peer hospitality, food delivery, transit platforms, online travel agents, e-commerce marketplaces and other gig economy and sharing economy businesses. OTT Risk is offering an income protection cover backed by Apollo which is structured as a service guarantee to the sharing economy platform users.

Cerchia to source $200m capacity for ILW market

US • Hurricane

Cerchia, which provides a parametric risk transfer marketplace between capital market investors and buyers of coverage without intermediaries, is looking to source $200 million USD in capacity from non-traditional sources. The capacity will be used for industry loss warranties (ILWs). ILWs are parametric risk transfer products that use industry loss data, often supplied by Verisk Property Claim Services (PCS), as an index. A pay-out is triggered if the industry loss from a catastrophe is greater than a certain threshold. Cerchia aims to make the capacity available before the northern hemisphere hurricane season.

Study highlights trapped collateral challenge with US wind ILWs

US • Hurricane

A study into ILWs from consultancy Kriesch Advisors, commissioned by Cerchia, found risks of trapped collateral for investors. Insurers buy ILWs from investors, who reserve capital as collateral to pay the insurer in case the trigger is met. Investors may need to hold collateral for months after an event, unable to redeploy the capital until the final Verisk PCS estimate is available. Kriesch found that this could create a misalignment of interest between buyers and sellers of protection. Cerchia is working with Kriesch and consultant Allemond to develop a new approach to ILW trading.

Case study: Descartes corporate hurricane cover

US • Hurricane

Parametric insurance MGA Descartes Underwriting’s case study shows how a corporate client purchased $75 million USD of parametric coverage against hurricane risks across the Southeast US. Descartes offers parametric hurricane insurance solutions using ‘cat in a circle’ or ‘wind at location’ approaches.

Ping An launches parametric product with carbon sink index

China • Carbon • Agriculture

Chinese insurer Ping An has launched a parametric insurance product covering oceans against changes in the marine environment that affect their ability to absorb carbon dioxide. Oceans are considered ‘carbon sinks’, meaning that they absorb more carbon than they release. Ping An’s carbon sink index is designed to measure the ocean’s ability to absorb carbon dioxide. When typhoons, abnormal temperatures, algae blooms or other changes in the marine environment reduce the carbon sink effect, a pay-out is triggered to fund efforts to restore the ocean’s carbon sequestration ability. The product is being piloted with ¥400,000 RMB ($59,000 USD) of protection in Dalian, Liaoning.

Etherisc and ACRE Africa update crop insurance product

Kenya • Agriculture • Blockchain

Over 25,000 smallholder farmers in Kenya are insured by microinsurance company ACRE Africa’s parametric rainfall insurance product in partnership with Etherisc, which provides parametric insurance smart contracts. Etherisc has announced that the companies are partnering with blockchain provider Celo to reduce pay-out times from 5 days to less than 24 hours. They will also transition from using rainfall data as the index to soil moisture data.

Revo Insurance launches hybrid parametric earthquake cover

Italy • Earthquake

Italian insurer Revo Insurance has launched Specialty PropertyXSME, a commercial property insurance product that covers risks such as fire, property damage and theft on an indemnity basis and earthquake risk on a parametric basis. The parametric earthquake cover pays out based on peak ground acceleration data from Italy’s National Institute of Geophysics and Volcanology (INGV). REVO-SPAC, a special-purpose acquisition company focused on parametric insurance, acquired Italian insurer Elba Assicurazioni in 2021 and became Revo Insurance. Revo launched its first parametric weather product in July 2022.

Extreme heat microinsurance for women workers in India

India • Temperature

Parametric insurance technology company Blue Marble has collaborated with the Adrienne Arsht-Rockefeller Foundation Resilience Center and Indian trade union Self Employed Women’s Association (SEWA) to create a parametric microinsurance product. Extreme heat can result in low-income women in India’s informal sector working in dangerously hot conditions. Pay-outs from the microinsurance product are designed to replace income so women do not have to risk their health in extreme heat.

Newly formed MGA acquires forestry underwriting division

Wildfire • Agriculture

Specialty MGA UK, which started underwriting in 2022, has acquired ForestRe, a forestry, agriculture and parametric underwriting team, from MGA Globe Underwriting. ForestRe offers a parametric wildfire insurance product for forestry and agriculture, using satellite imagery.

535 Fiji microinsurance pay-outs triggered

Fiji • Rainfall • Agriculture

Heavy rainfall in Fiji has triggered pay-outs to 535 individuals covered by the parametric microinsurance product introduced by the United Nations Capital Development Fund. The microinsurance product for smallholder farmers, fishers and market vendors was launched in 2021 for cyclone cover, while rainfall triggers were added in 2022. FijiCare is the lead insurer for the product and Weather Risk Management Services (WRMS) is the calculation agent.

St Lucia utility purchases parametric hurricane insurance

Saint Lucia • Hurricane

The Saint Lucia Electricity Services Limited (LUCELEC), has announced that it purchased a parametric insurance policy from the Caribbean Catastrophe Risk Insurance Facility (CCRIF) in October 2022. The tropical cyclone policy is designed to cover losses to the transmission and distribution components of the electric power system due to wind. CCRIF generally provides coverage to governments, but LUCELEC is its second electric utility member after the Anguilla Electricity Company (ANGLEC).

ATLAS: your portal to the parametric insurance world

ATLAS

InsTech has launched our insurance technology vendor and market intelligence database, covering over 1,000 technology companies, data providers and MGAs in parametric insurance and other areas of innovation. ATLAS can help you with partner identification, competitive landscape evaluation and investment analysis. InsTech Gold and Silver corporate members get a number of searches included within their membership. If you’re interested in ATLAS email [email protected] and we can provide a demo and talk through your requirements.