The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… growing broker involvement in parametric

The vast majority of commercial parametric insurance policies are sold through brokers. Historically, parametric insurance was distributed by just a small number of large and specialist brokers, but now all kinds of brokers are involved in placing parametric insurance solutions, aligning with increasing buyer interest.

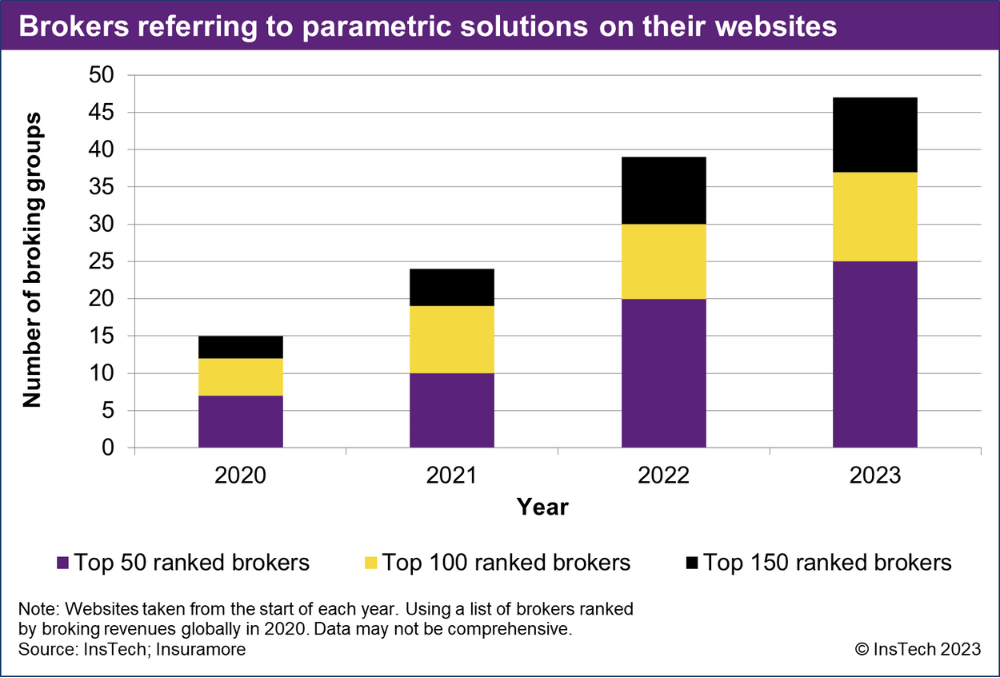

Brokers use their websites to market their capabilities to prospective and existing clients. Using this as a metric to indicate brokers’ involvement in parametric insurance, we reviewed the websites of the top 150 brokers globally, and their subsidiaries, for mentions of parametric solutions. Nearly a third of the largest brokers mention parametric on their website, including half of the top 50 brokers, showing that many brokers are now directing clients to parametric solutions.

Where we could find information about when parametric content was uploaded, we found that more than half the brokers that mention parametric on their websites today have added it to their websites in the last three years. Many of these brokers are also actively helping educate clients about parametric insurance through blog posts setting out how parametric covers can help with specific risks, such as natural catastrophes or business interruption, that are otherwise challenging to cover.

Because broker websites are client-facing, the increase in the number of brokers highlighting parametric in their product pages also suggests that the awareness of parametric insurance among insurance buyers is growing. More brokers want to be seen to offer a new type of insurance product that their clients are beginning to ask about.

If your company is an InsTech corporate member, you can contact Henry Gale on LinkedIn to find out the names of the 47 top brokers we identified that mention parametric solutions on their websites. If you’re not a member and would like to learn more, contact us at [email protected].

Insights from the World Economic Forum 2023

Carbon • Blockchain • InsTech event

Parametric insurance is playing an increasing role in creating a more sustainable world, with solutions that extend into climate, agricultural stability, clean energy and other areas. In an online event on Thursday 9 February, InsTech’s Robin Merttens will discuss blockchain, parametric insurance and third-party data with Chainlink Labs’ Charlie Moore, Mastercard’s Ruth Polyblank and Etherisc’s Christoph Mussenbrock.

In the news…

McKenzie Intelligence launches post-event hail data product

US • Hail

McKenzie Intelligence Services (MIS) has announced that post-event hail data for the US will now be available on its event response platform. MIS’ new capability records maximum hail size and sustained duration in affected areas and translates them into 1km x 1km grid squares. MIS provides damage assessments within 24 hours at a property level. MIS data can be used as a trigger for parametric insurance products, such as Yokahu’s hurricane policies.

Arbol transacts $170m gross written premiums in 2022

Climate • InsTech podcast

Arbol, which provides parametric climate and weather risk management solutions, has announced that it transacted $170 million USD in gross written premiums in 2022. This is more than double the $70 million USD in premiums Arbol transacted in 2021. Arbol also achieved cash-flow positive operations and profitable underwriting in 2022. To learn more about Arbol, you can listen to our recent interview with Founder and CEO Sid Jha on InsTech podcast episode 208.

WTW case study: how coral reef pay-out was used

Belize • Hurricane

Hurricane Lisa triggered the Mesoamerican Reef’s parametric hurricane insurance in November 2022. A new case study from broker WTW explains that the insurance product was structured as a ‘cat in nested circles’ policy. This means that the size of a pay-out depended on the hurricane’s maximum wind speed and distance from the reef. The pay-out of $175,000 was used to deploy trained brigade members who assessed damage to the reef and carried out the first phase of response activities.

Travel insurance platform integrates Blink’s parametric solutions

Travel

Blink Parametric has partnered with Firemelon to provide its white-label parametric solutions to Firemelon’s customers. Firemelon provides travel insurance sales and administration systems to over 30 insurers, brands, brokers, claims handling and assistance companies. Firemelon’s customers can now integrate Blink’s flight delay and luggage delay products in their own travel insurance offerings.

Wakam-backed parametric travel rain insurance launched

Europe • Travel • Weather

MGA Wetterheld has launched a parametric travel rain insurance product, available for journeys within the European Union. The product, sold through travel agencies including LMX Touristik and Hotelsicherer, pays €100 to travellers for every rainy day on their trip. Wakam provides insurance capacity for the product.

Partnership develops parametric carbon offset insurance

Carbon • Blockchain • InsTech newsletter

Disasters such as wildfires can put carbon offset projects at risk and invalidate carbon credits. A new partnership is using blockchain technology for parametric insurance covering carbon offset projects against disasters. Chainlink’s blockchain oracle technology connects Floodlight’s geospatial weather data to Etherisc’s parametric insurance smart contracts. An initial use case for the product covers trees whose carbon offsets are tokenised on Coorest’s platform. You can learn more about carbon credits and the need for carbon credit insurance in Issue 3 of InsTech’s Climate Risk newsletter.

Pharmaceutical captive uses Descartes parametric solution

France • Captive

Parametric insurance MGA Descartes Underwriting, in partnership with Generali Global Corporate & Commercial, has structured a bespoke parametric contract for Carraig, a captive insurer owned by Sanofi. Sanofi, based in France, is one of the largest global healthcare and pharmaceutical companies. A captive insurer is a subsidiary wholly owned by its parent company. The captive provides insurance for its parent company and companies within its group. A captive may buy parametric reinsurance against catastrophic and other risks which affect its portfolio.

$12m funding and new hurricane feature for flood data start-up

US • Flood

Floodbase (formerly Cloud to Street) has announced a $12 million USD Series A funding round led by Lowercarbon Capital. Floodbase specialises in providing near-real-time flood data for parametric flood insurance products. It has also launched a new feature that allows insurers to add flood triggers to parametric hurricane insurance policies. Most existing parametric hurricane policies use triggers based on wind metrics only. Floodbase’s parametric insurance partners include WTW, Raincoat and the African Risk Capacity.

Parametrix to pay claims after Azure outage

Cyber • Business interruption

Microsoft suffered a networking outage on its Azure cloud platform on 25 January, which triggered pay-outs to some policyholders of parametric cyber MGA Parametrix. Parametrix protects companies against business interruption losses caused by IT downtime. Parametrix says the downtime on 25 January lasted 2 hours and 24 minutes.

Brazil insurer raises $5.3m to develop parametric offering

Brazil • Agriculture • Weather

Newe Seguros has received R$27 million BRL ($5.29 million USD) in funding from the InsuResilience Investment Fund to develop parametric insurance products. Brazil-based Newe specialises in agriculture insurance and plans to launch weather and yield parametric products for small-scale farmers, aiming to reach more than 1.9 million beneficiaries by 2027. Newe was originally the Brazilian arm of insurer Markel, but Markel sold the unit to its management team in 2019.

Parameter Climate plans expansion and platform launch

Climate

Parametric insurance MGA and advisory firm Parameter Climate has announced that it achieved a profit in 2022, its first full year of business, after launching in late 2021. Parameter Climate plans to increase its insurance capacity and launch its pricing platform ClimateDelta in 2023. In 2021, Parameter Climate agreed a multi-year capacity partnership with, and investment from, reinsurer SiriusPoint.

Find out what you’ve missed…

Issue 40 – Parametric insurance for infectious disease outbreaks

Issue 39 – Parametric companies raise $300m in 2022

Issue 38 – Parametric initiatives at COP27

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.