The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… who cares about parametric insurance?

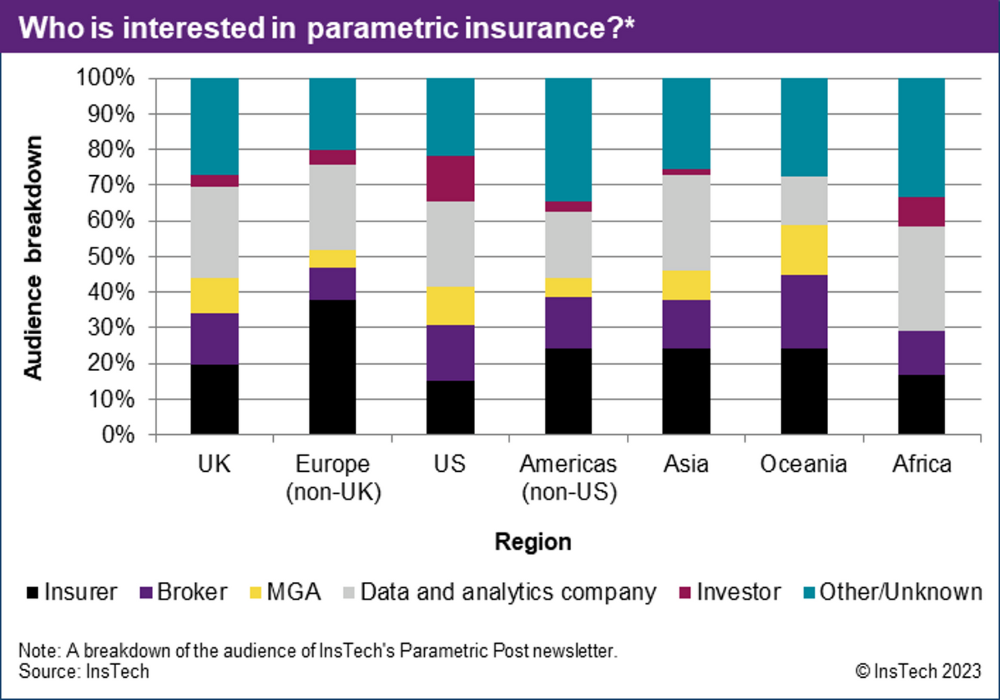

We launched the Parametric Post newsletter two years ago. As the parametric insurance market has grown, interest in parametric has grown even wider. Nearly 1,500 of you from more than 68 countries now track the latest parametric insurance news and insights every two weeks, with 600 joining in the last 12 months.

People from more than 700 organisations follow the Parametric Post, both within and outside the insurance market. Brokers and insurers on every continent are now involved in parametric insurance, making up 37% of subscribers to the newsletter overall. Well over 200 MGAs and data and analytics companies follow parametric insurance news, many of them start-ups and scale-ups developing new models or products for the parametric market. The others include investors (particularly in the US), professional services companies, regulators, governments and corporate risk managers.

Parametric insurance remains a niche area of insurance, but its rise has caught the attention of some outside the insurance industry. This week’s Parametric Post includes examples of organisations outside insurance choosing to fund, support or purchase parametric insurance. The growth of the parametric insurance market depends on more such organisations becoming aware of and understanding parametric solutions.

To find out more about how you can include your company’s news in the Parametric Post, contact us at [email protected].

Marine insurance – successfully navigating innovation waters

Supply chain • InsTech article

InsTech’s latest article discusses innovations in marine insurance, including product development and insurers’ adoption of new technologies. Read the article to find out more about how Parsyl and Otonomi have developed parametric covers for the marine insurance market and how they are changing the traditional insurance claims process.

In the news…

The parametric insurance market in Southeast Asia

Asia • Energy • Agriculture

Parametric insurance adoption is growing in Southeast Asia, with increasing traction in the renewable energy, agriculture, manufacturing, tourism and hospitality sectors, according to Descartes Underwriting’s Robert Drysdale. Descartes’ article sets out the market conditions for climate risk insurance in Southeast Asia and how parametric solutions can help.

Greenlight Re partners with parametric supply chain start-up

US • Agriculture • Supply chain

Reinsurer Greenlight Re is working with biotechnology company Aanika Biosciences, a current participant in the Lloyd’s Lab accelerator programme. Aanika Biosciences has created a parametric food recall and contamination insurance product, which uses biotechnology to trace food through the supply chain. The company announced its first policy in January 2023.

Parametric start-ups to test flood insurance in Virginia

US • Flood

Plover Parametrics and Ric, two parametric insurance start-ups founded in 2022, are among the five winning companies selected by nonprofit RISE to test flood insurance innovations in Hampton, Virginia. Each company will receive up to $300,000 USD in funding.

Understanding the top climate risks facing businesses

Climate

Arbol’s latest blog post explains the difference between physical, transition and liability climate risks to businesses and sets out best practices for mitigating climate risks. Arbol provides climate risk mitigation services alongside parametric insurance and reinsurance products for climate risks.

Guidewire launches new parametric feature

Core system

Technology company Guidewire, whose core systems are used by more than 500 insurers, has announced a series of updates to its platform including a new solution for insurers to launch parametric insurance products. The new feature supports designing parametric products, integrations with trigger data providers and automatic claim initiation after triggers are met.

Guy Carpenter parametric solutions for cyclones and wildfires

Tropical cyclone • Wildfire

Reinsurance broker Guy Carpenter has published an article explaining the products it has built for designing parametric tropical cyclone and wildfire insurance policies. The products, GC StormGrid and GC FireCell, involve dividing a geographical area into grids and measuring the impact of a catastrophe on the cells in the grid. You can read the article for details of how the product works in practice.

Descartes: event cancellation cover against extreme weather

Rainfall • Business interruption

Adverse weather-related losses from event cancellations or postponements are often excluded from insurance policies. Descartes Underwriting’s case study shows how a race track event management company has purchased parametric insurance against rainfall since 2019, with an on-site weather station providing data to trigger pay-outs.

WRMS launches parametric insurance marketplace

India • Weather • Agriculture

Weather Risk Management Services (WRMS), which provides data and technology for parametric insurance for smallholder farmers in Africa and Asia, has launched SecuRisk, a digital parametric insurance marketplace. SecuRisk is designed to help insurers design and operate parametric weather insurance products and connect them to brokers, aggregators and end customers.

Parametric portfolio loss reinsurance product launched

US • Convective storm

Investment advisor Resolute Global Partners, reinsurance broker Gallagher Re and catastrophe modeller Karen Clark & Company (KCC) have launched Footprint, a new catastrophe reinsurance product for the US. The product pays out based on modelled losses to an insurer’s portfolio calculated by KCC. The pay-out triggered will depend on the estimated loss calculated by the model. The first transaction with this product covers severe convective storm risk.

Commitment to parametric insurance for 100 million farmers

Africa • Agriculture • Weather

Parametric insurance technology company Pula has committed to insuring 100 million farmers in sub-Sarahan Africa by 2026. The commitment is one of a range of private sector investments for climate resilience, adaptation and mitigation in Africa announced during US Vice President Harris’ visit to Zambia. Each policy offers $200 USD of coverage, so covering 100 million farmers would require $20 billion USD in insurance capacity. Pula has not revealed how many farmers in sub-Sarahan Africa it insures today, but just over 9 million farmers have been covered by its parametric products across Africa and Asia since 2015.

Drought triggers $188k pay-out to Gambia

Gambia • Drought

The African Risk Capacity (ARC), a multi-country parametric risk pool, has paid $187,641 USD to the government of Gambia after a drought triggered its parametric insurance policy. According to ARC, more than 150,000 people were affected by the drought. As previously reported in Parametric Post issue 43, the World Food Programme, which also had a drought insurance policy covering Gambia, received an equal pay-out. ARC recently announced that it had selected Gallagher Re as its reinsurance broker and is planning to use alternative sources of capital, such as insurance-linked securities, to increase its capacity.

Heat index insurance for cattle launched in India

India • Agriculture • Weather

Agriculture Insurance Company of India is now offering Saral Krishi Bima, a parametric insurance product for cattle farmers that covers losses due to extreme heat. Higher summer temperatures lead to reduced milk production, resulting in losses for cattle farmers. The insurance product pays out based on temperature triggers being met in April and May. Start-up IBISA Network and broker AIMS were involved in designing the product.

15,000 farmers insured in Nepal pilot programme

Nepal • Agriculture • Weather

The United Nations Capital Development Fund recently completed a pilot programme with Pula and microfinance institution Jeevan Bikas to offer area yield index insurance to smallholder farmers in Nepal. 15,000 farmers were covered, with a total combined coverage limit of $4 million USD. Area yield index insurance protects farmers against reduced crop yield by measuring a geographical area’s average yield for a season against previous seasons. Pay-outs are triggered if the reduction in yield exceeds a predefined threshold.

Find out what you’ve missed…

Issue 46 – Parametric solutions for corporate earthquake risk

Issue 45 – Parametric opportunities in semiconductor supply chains

Issue 44 – Building momentum for parametric flood insurance

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.