The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… five approaches to parametric drought insurance

Drought is becoming a globally pervasive peril, exacerbated by climate change. It inflicts financial losses on the food production sector, any industry dependent on agricultural commodities and hydropower. Parametric solutions, which pay out based on an index, can cover these losses. The index measures the severity of the drought event. It should correlate with the loss as closely as possible to minimise basis risk (the risk that the pay-out differs from the loss incurred). We’re aware of five different indices being used for parametric drought coverage.

The simplest is a rainfall index: if it rains less than a predefined amount over a period of time, a pay-out is triggered. The value of the pay-out depends on the amount of rain. This is the easiest to measure and the most transparent because there is a vast amount of publicly available present and historical data on rainfall. A rainfall index is used for the Ruzhowa/Uthango insurance programme discussed in this issue.

The African Risk Capacity, a multi-country risk pool, uses the Water Requirements Satisfaction Index, developed by the United Nations Food and Agriculture Organization, for its parametric drought coverage. This augments rainfall data with information on how much rainfall is needed to satisfy the needs of crops in different locations.

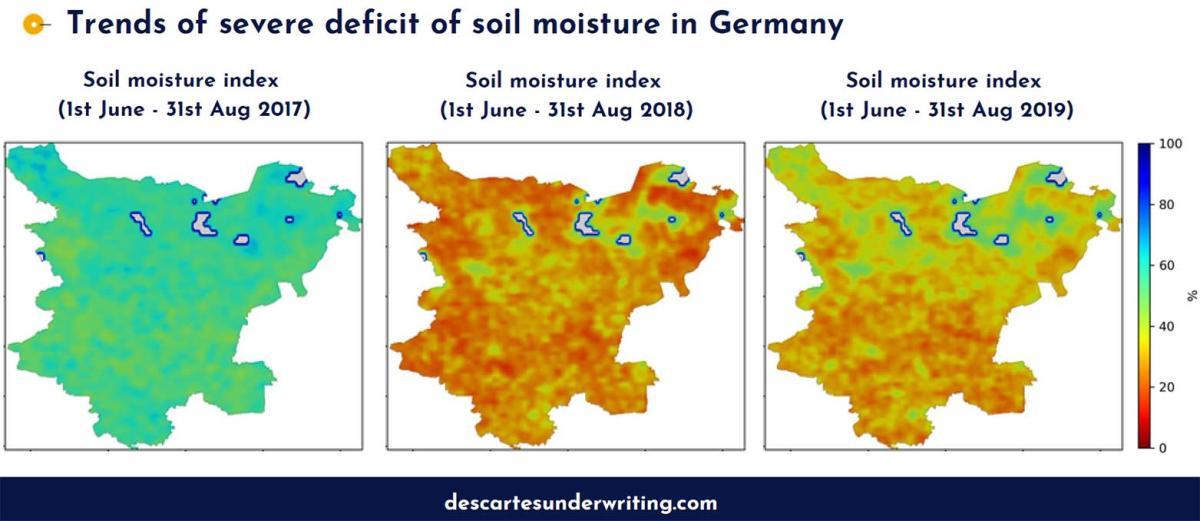

Descartes Underwriting writes in its latest report about the soil moisture index it uses, which is also intended to correlate closely to crop yield. Data providers such as VanderSat, which works with Descartes, AXA Climate and Swiss Re, provide global soil moisture data.

OKO’s recently launched product in Uganda (more details later in the issue) uses a relative evapotranspiration index, which is an algorithmically-calculated measure of change in the release of water from soil and plants (part of the water cycle).

Another option is parametric insurance with a yield-based index. This involves collecting data on agricultural yield across an area or region and paying out to policyholders when the average yield in their area has dropped significantly.

Choosing the right index is a crucial part of structuring a parametric policy. The choice involves weighing up transparency, basis risk, technological complexity and cost. For drought coverage, insurers have several options to structure the solution that suits their policyholders’ needs best.

Parametric insurance report 2022 – get your discount code now

InsTech report

InsTech’s upcoming report, “Parametric Insurance in 2022: 150+ companies to watch”, will be published on 14 June 2022. It will be free for InsTech corporate members to download. Everyone else can apply now for a free discount code.

What parametric solutions are you working on?

InsTech report

If you have a parametric offering and want to make sure your company will be covered in our report, contact Henry Gale on LinkedIn. We’re also interested in speaking with risk managers or other commercial buyers of parametric insurance to hear their views on the topic.

In the news…

Skyline and Howden create hurricane cover for agriculture

Jamaica • Hurricane • InsTech podcast

Skyline Partners, which provides technology and a calculation agent for parametric insurance products, has structured a parametric hurricane insurance product for Jamaican farmers. The product is being delivered with broker Howden Group and capacity from reinsurer Munich Re. The Jamaica Co-operative Credit Union League (JCCUL), which provides loans to around 100,000 smallholder farmers, is the policyholder. In the event of a severe hurricane, the JCCUL receives a pay-out to replace funds lost from farmers defaulting on loans. We spoke to Skyline’s co-founder Gethin Jones on InsTech podcast episode 146.

Blink partners with travel insurance marketplace baoba

Travel • Embedded • InsTech interview

Blink Parametric (part of CPP Group), which offers white-label consumer parametric insurance products, has partnered with start-up baoba, founded in 2022. Blink’s travel insurance solutions will be offered through baoba’s insurance marketplace. baoba connects insurance products from multiple insurers with travel sector organisations so that coverage can be embedded in customer journeys. We spoke to Blink’s Carl Carter for a spotlight interview last month.

Parametric drought insurance case studies from Descartes

Agriculture • Drought

MGA Descartes Underwriting’s report on drought risk shows how it has structured parametric drought covers for agricultural clients in Argentina, Germany and France. The report reveals how its policies would have paid out during droughts in recent years. Descartes uses soil moisture, measured by satellite imagery, as an index for drought coverage.

Drought and flood insurance launched for Ugandan farmers

Uganda • Agriculture • Weather

OKO, which distributes weather index insurance products in Africa through mobile networks, is now offering drought and flood insurance for smallholder farmers in Uganda. Policies are underwritten by Jubilee Insurance and Allianz. Agriculture data provider eLEAF is measuring the relative evapotranspiration index. OKO was founded in 2017 and raised $1.3 million in seed funding in 2021.

Mitsui Sumitomo partners with Brazil meteorological agency

Brazil • Weather

Brazil’s National Institute of Meteorology, INMET, has partnered with insurer Mitsui Sumitomo to develop new parametric weather insurance solutions in Brazil. This is INMET’s second parametric insurance partnership, as part of the institute’s aim to use its data to promote climate risk management in Brazil. It announced it was working with Swiss Re Corporate Solutions in February 2022.

Developing a smallholder farmer parametric product

Zimbabwe • Agriculture • Weather

The index insurance programme Ruzhowa/Uthango is run by MGA Blue Marble, insurer Old Mutual Zimbabwe and public-private partnership SCBF. Ruzhowa/Uthango covers smallholder farmers in Zimbabwe against drought, excess rainfall and wind. A new study describes the companies’ experiences in implementing the product over two years. It concludes that a next step would be to switch to yield-based (rather than weather-based) insurance and policies should be distributed through government farmer support programmes.

World Food Programme climate risk insurance report

Humanitarian aid • Weather

The World Food Programme (WFP), a humanitarian organisation and part of the United Nations, is involved in designing and implementing parametric microinsurance solutions around the world. In its newly released annual report for 2021, WFP details the expansion of index insurance programmes globally and records major pay-outs triggered in Ethiopia, Malawi, Madagascar and Mali.

Create your InsTech website account

InsTech events • InsTech reports

Employees of InsTech corporate members can now register for our events and reports by creating an account on our website. Once you are logged in your member discounts will automatically be applied to our events and reports forms. If you’re not sure whether your company is a corporate member, you can check using this link. Need a hand? Email [email protected].

Find out what you’ve missed…

Issue 23 – Building partnerships for parametric insurance

Issue 22 – Experience of loss driving parametric insurance innovation

Issue 21 – Parametric insurance with social impact

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.