Introduction

In parts of the world highly exposed to catastrophes, traditional property insurance comes with large deductibles, low limits or is simply unavailable. Many organisations have turned to parametric insurance to fill gaps in coverage, especially for tropical cyclones and earthquakes.

The financial losses from natural catastrophes are not just physical damage. Catastrophes can cause sharp revenue drops or make normal operations impossible—consequences shared with other extreme events, natural or manmade, including pandemics, terrorism and cyber events.

We estimate that there have been dozens of extreme events in recent years that have caused more than $1 billion USD in non-damage business interruption losses, with a few examples below.

$30 bn 🌀

Estimated business interruption losses from Hurricane Sandy in 2012 which disrupted transportation and power supplies.

$1.7 bn 🌋

Lost revenue for the global airline industry after the 2010 volcanic eruptions at Eyjafjallajökull, Iceland.

$220+ bn 😷

Estimated lost revenue per month for small businesses in the US during the COVID-19 pandemic in 2020

£1+ bn ❄️

Estimated losses for small businesses during a 2009 freeze in the UK, with 20% of the workforce unable to get to work

$16 bn 🔥

Economic cost of haze in Indonesia in 2015, caused by fires across the region and resulting in lost productivity and tourism

€2 bn 🦺

Lost revenue for shopping centres in France during 2018-19 Gilets Jaunes protests

Sources: McGuireWoods, International Air Transport Association, American Property Casualty Insurance Association, Cambridge Centre for Risk Studies, BBC, Assemblée Nationale

Natural catastrophes and extreme weather

Tropical cyclones, earthquakes and floods cause business interruption to organisations that suffer no physical damage in several ways.

Hotels may be affected by people choosing to cancel their holidays or disruption to transport networks. Shops can suffer reduced revenue caused by footfall drops and customers tightening their spending. If employees are unable to get to work, warehouses may have to pause or slow operations.

Munich Re, which offers parametric insurance for earthquake, wind and flood globally, provides a media company in the Caribbean with a parametric hurricane policy to cover revenue loss. In the aftermath of a storm, media companies face various disruptions such as power outages disrupting electronic billboards.

Aon provides a California-based technology company with parametric insurance covering the economic damages associated with an earthquake, including the impacts on employees, local infrastructure and operations.

Flood coverage is a newer area of parametric insurance. Companies such as Fathom and JBA Risk Management are helping insurers model the impact of floods. Some parametric flood transactions done so far have involved sensor technology, such as from Previsico, monitoring the depth of a flood at a policyholder’s location. Sensors could also be positioned at other specific locations where flooding would cause business interruption to an area.

Floodbase is now using satellite data to enable parametric policies that pay businesses based on how a flood affects their area, rather than just their property. This can help cover business interruption risks associated with local flooding.

“In some cases, there is no physical damage from a catastrophic event, but there is non-damage business interruption. If your business is more complicated than the bricks and mortar that hold it up, then parametric insurance can solve problems that traditional insurance cannot.”

Some natural disasters can cause business interruption even before they begin. When the Hong Kong Observatory issues a typhoon warning of ‘signal 8’ or above, most companies in Hong Kong will not require employees to report for work and transport conditions may be disrupted. As a result, there are business interruption losses even if the typhoon never hits. Swiss Re Corporate Solutions offers local businesses a parametric product that pays out based on these typhoon warnings.

Local authorities also experience disruption and extra expenses after a catastrophe, even if none of their buildings are physically damaged. Munich Re structured a parametric earthquake policy for a major US metropolitan area. The policy covers the extra expenses required to maintain public order and keep public services running after an earthquake.

Extreme hot or cold weather can prevent businesses from operating normally. A freeze event in the UK in 2009 prevented 20% of the workforce from getting to work, causing over £1 billion GBP in business interruption losses. The US has experienced several extreme freezes in recent years, particularly in Texas in 2021. These are likely to have caused similar losses, although exact figures are not available. Some companies have structured parametric temperature insurance policies to cover NDBI losses from extreme freezes.

Poor air quality can also cause NDBI losses. Customers may choose to stay indoors or businesses may need to suspend operations for employee health and safety concerns. Wildfires in Canada caused haze across the Northeastern US in June 2023, with tens of millions of people subject to air quality alerts and official recommendations to limit outdoor activity.

In 2015, haze in Indonesia cost the country $16 billion USD. These conditions are more frequent in Southeast Asia, due to farmers clearing land for plantations and fires getting out of control. Swiss Re Corporate Solutions has designed a parametric product to protect businesses in Singapore from NDBI losses caused by haze. Cerchia is also designing parametric insurance products with air quality indices.

Micro-enterprises (single-person businesses or those that employ just a few people) are especially vulnerable to natural catastrophes as they rarely have savings to call on. Technology company Raincoat is one of the organisations developing and deploying parametric insurance programmes for micro-enterprises. Pay-outs are received quickly after hurricanes, floods or other disaster events to help with cash flow.

The financial safety net provided by parametric microinsurance can also help ensure the safety of people operating micro-enterprises. For example, fishing is dangerous in hazardous weather conditions. In some parts of the world, however, fishers may not be able to afford losing out on income during prolonged bad weather and choose to fish anyway, putting their lives at risk. In the Philippines, WTW has designed parametric coverage to fishers to compensate them for lost fishing days (using wind speed, wave height and rainfall triggers) and encourage safe fishing. A pilot is expected to launch in 2024.

Parametric insurance is increasingly used to cover other natural catastrophe risks, including tornadoes, hail, tsunamis and wildfires. Though these policies are usually designed to cover physical damage, they could pay out in NDBI scenarios and there may be use cases specifically for NDBI risks as well.

Parametric volcanic eruption coverage is extremely rare, but one transaction brokered by Howden for the Danish Red Cross involves monitoring ash plume height and wind speed to determine where ash will fall, with modelling firm Mitiga Solutions as the calculation agent. Given the losses to the airline industry caused by airborne ash in 2010, a future use case of parametric insurance could involve ash-related triggers to cover NDBI risks for airlines.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’

Other extreme events

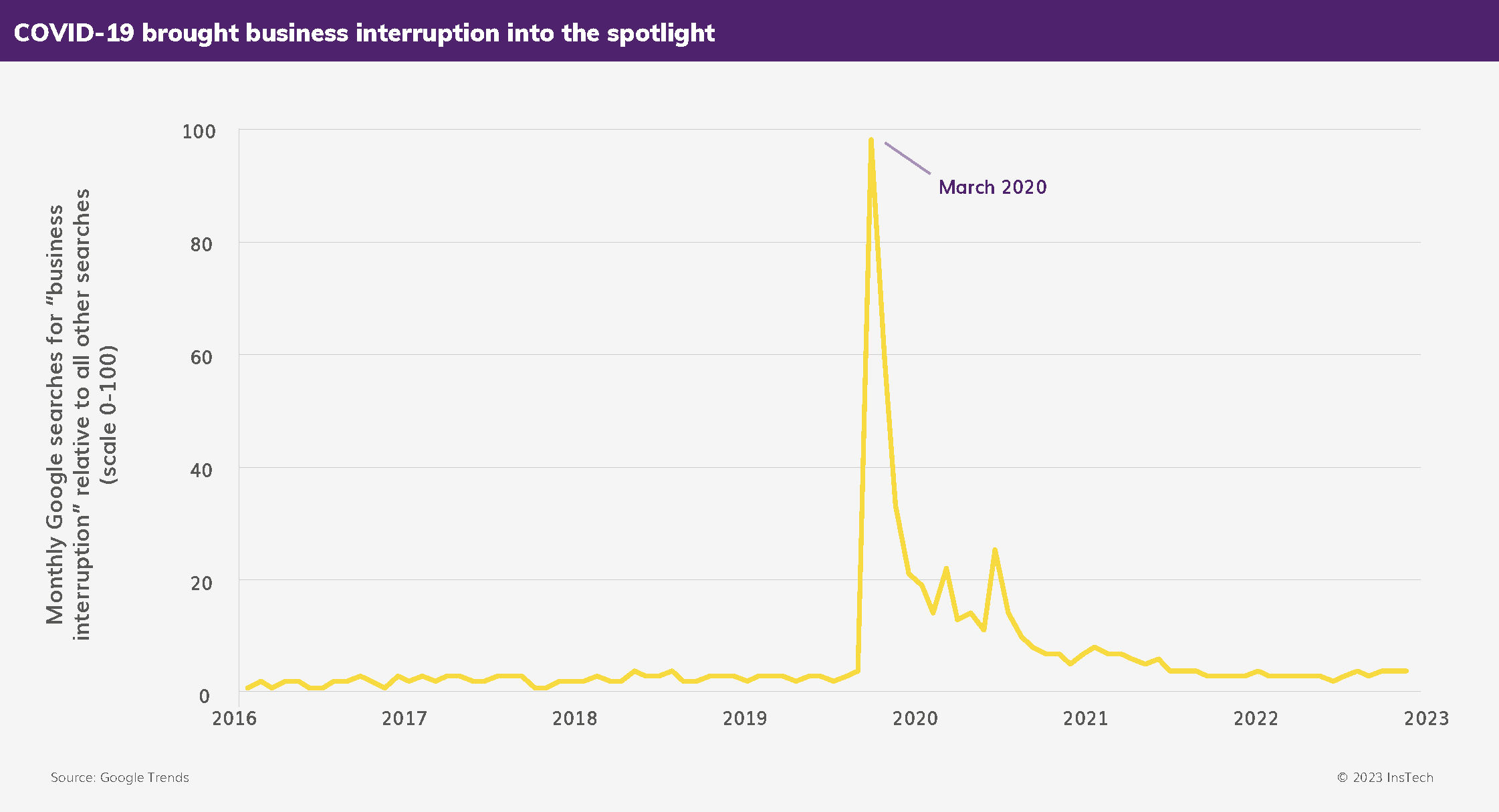

It is not just weather and geological events that can cause sudden changes in demand or halt operations. Awareness of NDBI risks surged during the COVID-19 pandemic, when many organisations that had not previously considered pandemics a significant risk experienced large business interruption losses. In many cases, they thought they were covered, but their insurer disagreed. Legal disputes ensued around the world.

Before COVID-19, there was little interest in insuring pandemic risks. In 2018, Marsh developed a parametric product to protect businesses against NDBI losses from disease outbreaks, in collaboration with Munich Re and health data provider Metabiota. No companies purchased the product before the COVID-19 pandemic.

Since 2020, more organisations have chosen parametric coverage for epidemics and pandemics, although it remains a very niche product. Pay-outs for these policies usually depend on more than one trigger being met. Triggers may include an outbreak declaration from the World Health Organisation, specific numbers of deaths or cases from the disease or a civil authority issuing specific restrictions on businesses.

Munich Re, which offers parametric (as well as indemnity-based) insurance for epidemic and pandemic risks, partnered with health security firm International SOS in October 2023. Munich Re pandemic policyholders will be able to access health advisory services at any time, even before a pay-out is triggered. This can help companies respond to pandemics early in a way that mitigates business interruption and other risks, in addition to receiving a payment at the time of loss.

Disruption to businesses can also be caused by local disorder or violence. Shopping centres in France lost out on €2 billion EUR in revenue during the violent Gilets Jaunes protests in 2018 and 2019. Following the 2017 terror attacks on London Bridge, local businesses were denied access to their premises for five and a half days on average. Some parametric products have been designed to cover these types of risks.

AEGIS London launched parametric ‘active assailant’ coverage, in partnership with Skyline Partners, in 2021, to help SMEs in Texas recover from business interruption after nearby attacks. The trigger is any murder or assault with a weapon reported by the local police in a defined area around a policyholder’s location. AEGIS London and Talbot Underwriting are also providing capacity for MGA New Paradigm Underwriters’ terrorism coverage.

McKenzie Intelligence Services’ natural hazard data is used as a calculation agent for some parametric insurance policies and the company also produces post-event information about conflicts, explosions and public disorder which could be used for future parametric policies. S&P Global, which already provides data to insurers for modelling and monitoring terrorism and political violence risks, is also working with insurers to develop indices that could be used for parametric coverage.

THE PARAMETRIC POST: AEGIS and Talbot back new parametric terrorism coverage (June 2023)

MGA New Paradigm Underwriters has announced that Lloyd’s syndicates AEGIS London and Talbot Underwriting are providing capacity for its parametric terrorism insurance product. The product pays out when terrorist events occur within a radius of an insured location, or at other key locations where attacks would cause a business interruption loss, such as an airport or power station. Coverage limits of up to $50 million USD are available.

Some organisations have also explored using parametric insurance to protect against the risk of local power outages. We are unaware of any transactions to date that rely solely on a power outage index, although some parametric policies are designed to protect against the NDBI losses from outages caused by hurricanes or earthquakes, where the parameters of the catastrophe determine the pay-out.

Cyber events are another cause of business interruption. In many cases, business interruption is linked to an event such as a ransomware attack and these losses are often covered by cyber insurance policies. A small number of companies are in the early stages of developing or bringing to market parametric policies to help respond to cyber events or cover NDBI risks not covered by most cyber insurance policies. Parametric insurance can also be used for NDBI losses associated with IT supplier downtime – you can learn more about this in our recent article Insuring interruptions in global supply chains.

All these use cases of parametric insurance for extreme events, other than natural catastrophes and weather, remain niche. It is usually clear if an organisation is in an earthquake-prone region or highly exposed to hurricanes, but the threat level is not as obvious with infectious disease outbreaks or terror attacks. This lack of appreciation of the risk and potential loss makes it less likely a company will spend money on a dedicated parametric policy for terrorism, for example, than for a more known risk such as earthquakes.

Another challenge is the price of coverage, caused by concentration of risk. With physical losses, insurers can manage their exposure by diversifying its coverage by peril and location. This is more challenging for cyber, pandemics and war risks that transcend physical boundaries. As a result, many insurers consider some of these risks uninsurable. Those that offer cover may do so at a very high price.

It can also be harder to build effective parametric triggers for these events. There is not always a good correlation between measures of an epidemic or pandemic (such as the number of cases) and the economic damage done to businesses. Similarly, terror attacks, political violence, shootings, war and protests may have the same disruptive effect on local businesses, but one parametric trigger may not cover them all. The effect of government or local authority action adds greater uncertainty.

For this reason, companies are developing parametric products that would cover NDBI losses caused by almost any peril, which you can learn more about by downloading the report Intact but interrupted: parametric solutions for non-damage business interruption risks.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’