Introduction

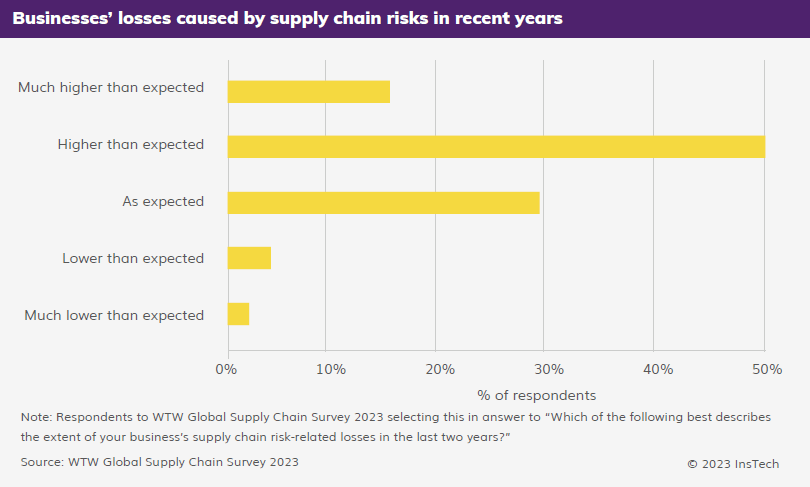

In recent years, 65% of risk managers and business leaders have experienced unexpectedly high losses from supply chain risks, according to WTW’s Global Supply Chain Survey (conducted in late 2022). Several factors, including the COVID-19 pandemic, geopolitics, macroeconomic developments and climate-driven catastrophes, have disrupted supply and demand. Shortages, congestions and delays compound each other.

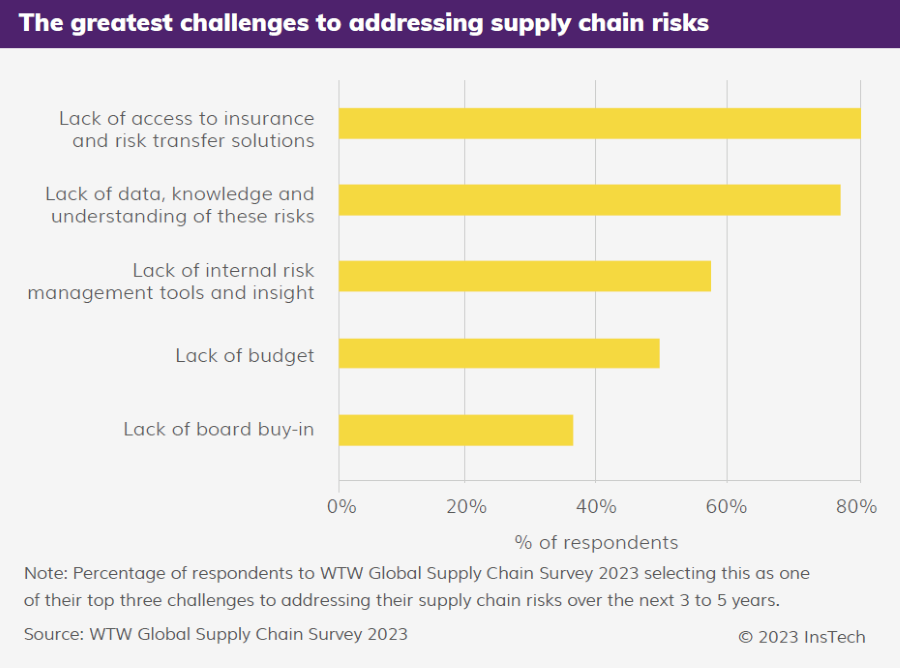

80% of those WTW surveyed said a lack of access to insurance and risk transfer was one of their greatest challenges in addressing supply chain risks. Parametric insurance products have been designed to tackle two scenarios not usually covered by traditional insurance: when businesses cannot operate as planned because their suppliers are interrupted; and when the transport of goods themselves is disrupted.

Overcoming risks in supplier networks

The most prominent application of parametric insurance to supply chain risks has been to insure catastrophes that affect organisations’ suppliers. In 2011, floods in Thailand and an earthquake and tsunami in Japan caused shortages of certain parts. This affected global electronics and automotive supply chains. Hurricane Harvey in 2017 affected organisations worldwide that depended on importing petrochemicals from the US. Floods in Kerala, India in 2018 destroyed spice crops, resulting in prolonged shortages and price increases for spices around the world. These risks are known as ‘contingent’ business interruption risks.

In sectors that depend on suppliers concentrated in one location, parametric insurance can help protect against events that would disrupt suppliers. For example, the semiconductor supply chain depends on a few large manufacturers in East Asia. One technology business that relies on semiconductors purchases parametric insurance for earthquakes in and around Taiwan that might affect its key supplier.

Agribusinesses such as cotton gins (businesses that refine and process cotton) depend on local crop production. One cotton gin in Texas purchased a parametric cover from Arbol that pays out when the local cotton yield drops. In 2020, poor weather conditions affected the cotton crop and the cotton gin received a pay-out compensating for its lost income.

When catastrophes, weather or other events disrupt the production of key commodities, this is usually reflected in the price. Another established way to manage supplier risks is to hedge against price increases for commodities. The financial derivatives used for hedging are not accessible to smaller businesses and only cover some commodities. Recently, start-ups such as MGA ChAI have designed parametric products to insure commodity price risk.

“Smaller companies are underserved by existing risk transfer solutions, such as options or futures markets, for commodity price risks, while even the largest companies find it hard to transfer risks for many materials, such as plastics and steel.”

The concept of insuring disruption to suppliers has also been applied to the digital economy, with start-up MGA Parametrix developing a parametric product covering e-commerce and other digital businesses against IT provider downtime (for example, Amazon Web Services, Google Cloud or Microsoft Azure outages). Howden recently brokered a deal to expand the MGA’s capacity, with backing from insurers including Apollo Underwriting.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’

Managing disruptions in transit

When major shipping routes are disrupted, losses occur across many industries. Low or high water levels can cause authorities to close shipping routes or order that boats must travel with reduced freight. Businesses may face delays, losses to perishable goods or extra costs associated with arranging last-minute alternative transport.

Low water levels in the Rhine in 2018 led to a 1.5% drop in industrial production in Germany, causing a 0.4% decline in the country’s gross domestic product (equivalent to €13.7 billion EUR). In recent years there have been similar river level disruptions in other key waterways including the Seine, Danube and Mississippi. Volatility in water levels is caused by changes in precipitation, temperature, snowmelt and some human factors; climate change is likely to make these events more frequent.

Several insurers now offer parametric policies using publicly reported water levels at key points as a trigger. For example, Howden has provided an organisation in Europe with a parametric policy covering loss of income and increased operating costs from low river levels. When the river drops below an agreed water level, set at a depth likely to cause disruption to shipping, the policyholder receives a daily pay-out depending on the depth.

Generali provides parametric water level coverage to a food supply company that transports goods through Germany and the Netherlands. When river levels are low, the organisation has to change from using a larger vessel to using a smaller vessel, which requires increased trips and results in changeover costs. The parametric pay-out is designed to compensate for these costs and help them continue to deliver on time.

Other forms of transportation can also lead to increased cost or lost revenues if disrupted. MGA Otonomi offers parametric coverage for air cargo delays, with insurance capacity from Greenlight Re. The policy pays out automatically based on how long the arrival of cargo is delayed, whatever the cause of the delay. Otonomi is also developing products for sea and land cargo delays.

Another MGA, Anansi, underwrites parametric coverage for goods lost in transit. Anansi provides indemnity-based insurance to retailers covering damage to products during delivery to customers. If the products are lost, a parametric pay-out is triggered automatically. Tokio Marine HCC, Liberty Mutual and Arch Insurance are providing insurance capacity.

“When the Ever Given was stuck in the Suez Canal, it was an eye-opener for organisations. They discovered that freight delays were completely excluded from their insurance while they suffered income losses, overspent wages, property damage, diminishing asset values and more.”

For some goods, a significant risk is failing to maintain the right conditions in transit. Parsyl is an MGA and insurer specialised in covering the cold chain—supply chains for goods such as medicines and seafood which need to be kept at cold temperatures. Parsyl has manufactured sensors which monitor the temperature of shipments. As an option on its all-risks cargo insurance policies, Parsyl offers a parametric cover that pays out automatically if sensors detect temperatures above a predefined threshold.

THE PARAMETRIC POST: Parsyl pays parametric temperature claim in under eight hours (June 2021)

An air shipment of seafood monitored by Parsyl was exposed to a problematic temperature after a plane delay left packages sitting on hot tarmac. The policyholder Niceland Seafood received a text message alerting them to the temperature exposure, the loss was confirmed and the claim was paid in under eight hours.

Given the complexity and diversity of supply chains and their risks, there are opportunities for insurers to design more parametric products for industries that face specific exposures. For example, semiconductor fabrication plants use millions of gallons of water every day to cool down equipment and clean silicon wafers (an essential material). Water shortages in regions where semiconductors are manufactured pose a risk to technology or automotive manufacturers elsewhere in the world; those companies might want to insure against water shortages and insurers could design parametric products to cover this risk.

According to the WTW survey, most companies lack sufficient supply chain risk data and the tools and insight they need to manage their risks. If industries work together with the insurance sector to solve their specific data challenges, greater access to reliable supply chain data could create opportunities to build indices for new parametric insurance products.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’