Wildfire in numbers

Some of the most expensive years for economic and insured losses from wildfires have occurred since 2016. According to Swiss Re, wildfires cost the insurance industry $70 billion (adjusted to USD 2023) between 2013 and 2022.

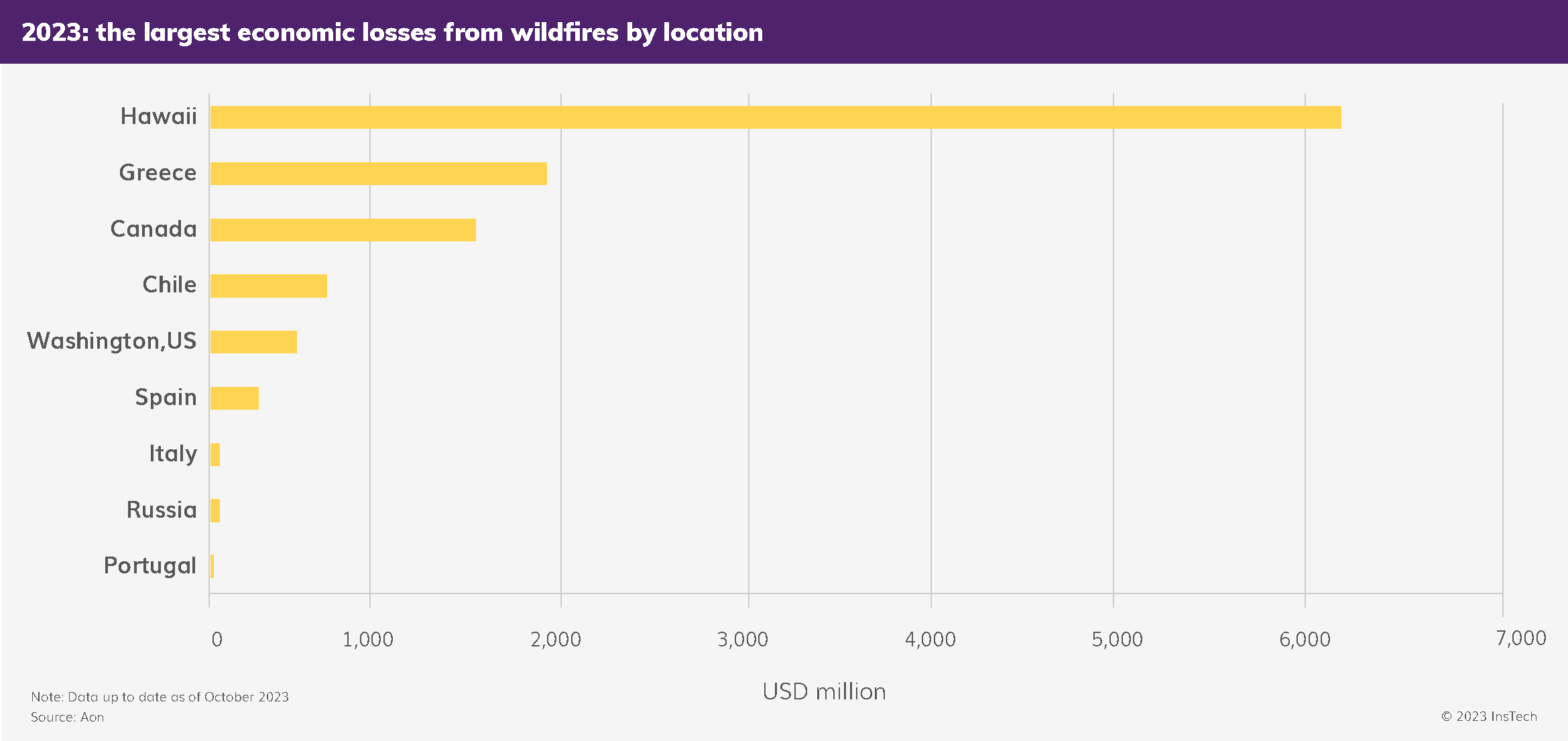

In early August 2023, a series of wildfires broke out in Hawaii, killing over 100 people and causing billions of dollars in damage. Canada also had its worst wildfire season on record with over 1,000 fires burning across the country. These fires have become the tenth largest insurance industry loss event in Canada’s history.

2023 in review: the largest insured losses from wildfire

$3-6 billion

Hawaii wildfires in August. Source: Aon, Guy Carpenter

$720+ million

Canada wildfires in British Columbia. Source: CatIQ

Significant wildfires were also experienced throughout Europe. Greece suffered about $1.8 billion in economic losses, followed by Spain ($245 million), Italy ($50 million) and Portugal ($10 million).

Download The Full Report

From the report ‘Beyond the smoke: Understanding and mitigating wildfire risk’

What causes a wildfire?

Wildfires are unplanned and uncontrolled fires, including lightning-caused fires, human-caused fires and escaped fires from prescribed burn projects.

Climate conditions such as high temperatures and droughts contribute to the drying of vegetation, creating potential fuel for wildfires. When combined with strong winds, fires are able to ignite and spread rapidly. But what is causing these wildfires to begin with?

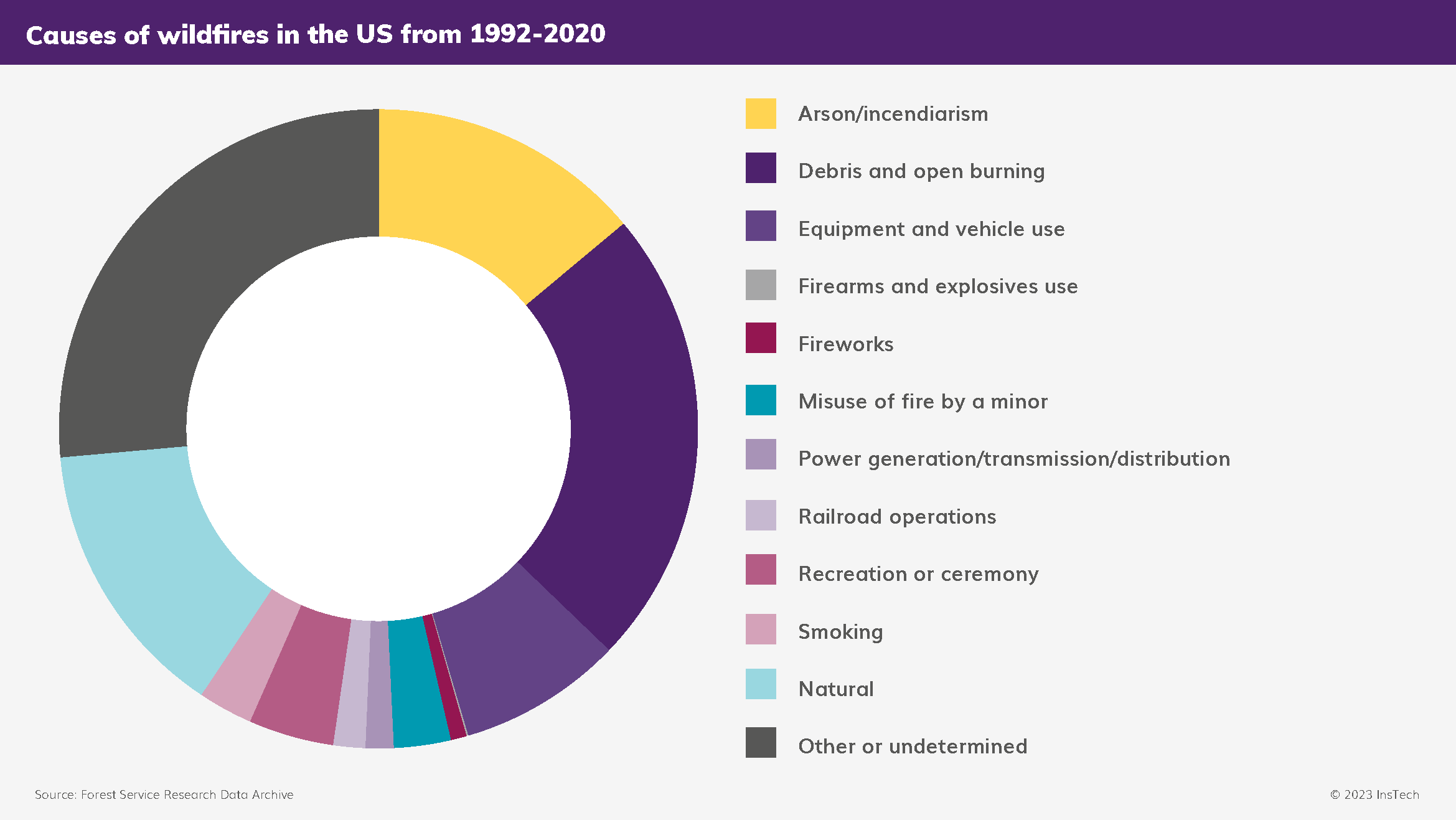

Research suggests that humans cause about 85% of wildfires in the US. People are accidentally starting them in some surprising ways; from a wayward smoke bomb at a ‘gender-reveal party’ to a wasp extermination attempt gone wrong.

Digging into the data

According to data from the United States Department of Agriculture (USDA), ‘open burning of debris’ is the largest identified cause of wildfires; 23% of fires were caused by this between 1992 and 2020. ‘Open burning’ refers to the burning of unwanted materials such as paper, leaves and other debris where the smoke is released directly into the air. Natural causes (from phenomena such as lightning) and arson or incendiarism each caused 14% of fires.

Only 2% of wildfires in the US have been started by power generation or distribution, but this cause has often been a large concern due to insurance and litigation reasons. In July 2023 lawsuits were filed against a utility company for its potential role in Colorado’s most destructive wildfire on record: the 2021 Marshall fire. It is thought that one of the causes of the wildfire was a spark from a power line.

The insurance risks

Wildfires, whether man-made or natural, affect a range of areas relevant to insurance. Physical damage is one of the largest, with both residential and commercial properties at risk. Residential properties tend to account for over 90% of insured losses from property damage.

After the 2017 northern California wildfires, residential insured losses were just over $3.1 billion and commercial losses represented $137 million.

Non-physical losses are also important to consider. Business interruption caused by smoke, physical damage and protection measures, such as road closures, can result in financial losses. This can be a particular issue for tourism and leisure activities, which can suffer from lost revenues due to park and resort evacuations.

Liability risk is a concern – and not just for energy companies. In the past, electrical utilities have received contributions to their liability costs from a range of other businesses including a cable provider, a tree-trimming company and electrical contractors.

Life and health is another area that can be affected by wildfires. Deaths and injuries can occur during a fire and there is the potential for longer term health impacts due to pollution. Down the line, this could result in a range of health and liability claims.

“When there is a wildfire, construction crews that spend a lot of time working outdoors may be exposed to potentially harmful airborne particles emanating from the wildfire, even when they are a long distance away from the wildfire. This exposure could, in turn, lead to an increase in workers’ compensation claims in the future.”

To learn how insurers are mitigating wildfire damage and what technology is out there to help with early detection and prevention, download the full report now.

Download The Full Report

From the report ‘Beyond the smoke: Understanding and mitigating wildfire risk’