The Parametric Post, the only newsletter dedicated to parametric insurance.

Thought for the day… promising signs for the parametric flood market

Flood, one of the most globally prevalent perils, remains significantly underinsured in 2024. Could this be the year that parametric insurance makes real inroads towards filling the flood insurance protection gap

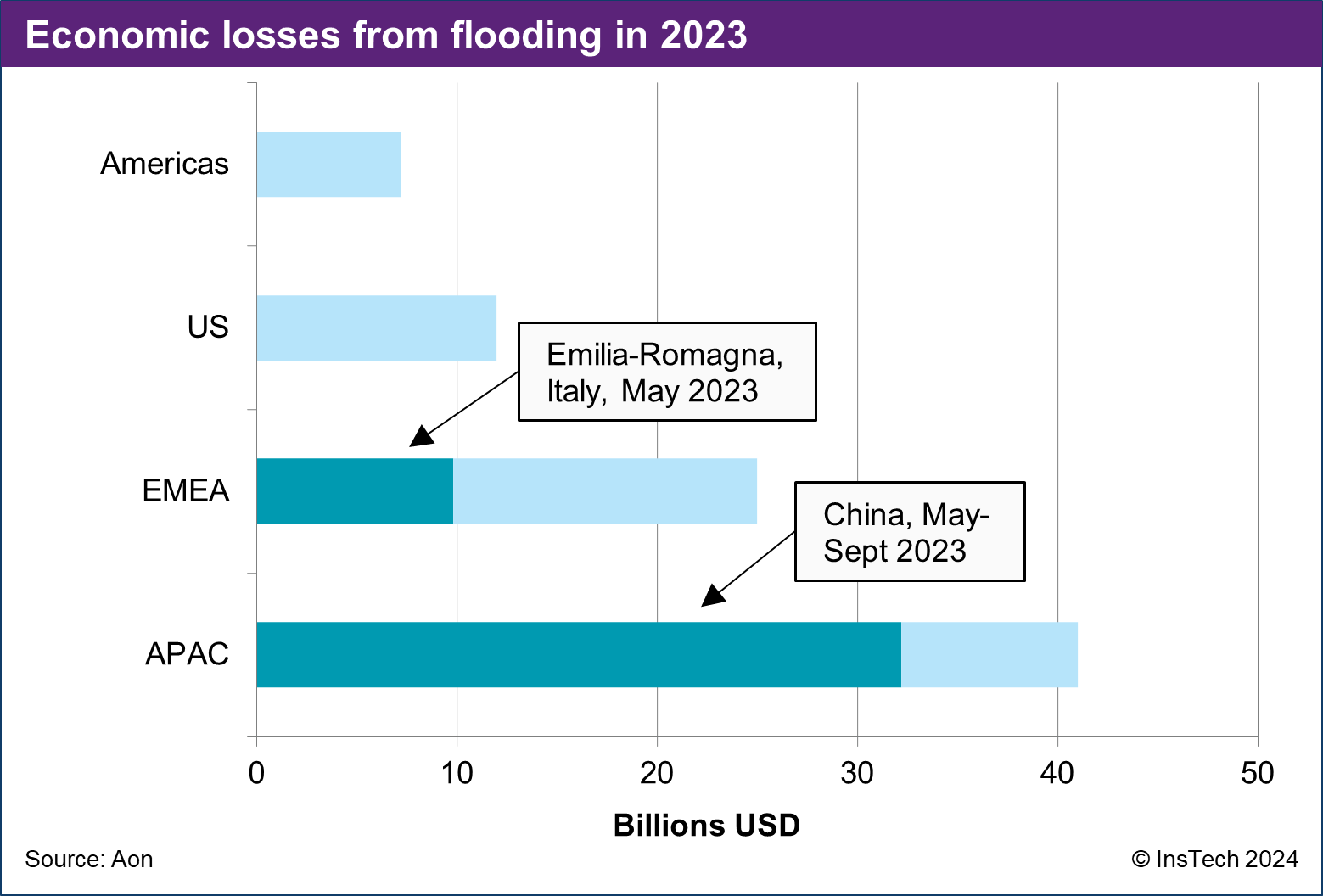

According to Aon’s Climate and Catastrophe Insight report, global flooding caused $85 billion USD of losses in 2023, of which only 15% was covered by insurance. The largest flood events were in China from May to September and northern Italy in May, resulting in $32 billion and $10 billion of losses respectively. Less than 10% of the losses from both events were insured.

Several provinces in China have purchased parametric catastrophe insurance in recent years for heavy rainfall, earthquake and typhoon risks. In 2022, cities in Guangdong received tens of millions in parametric pay-outs after floods. It is unknown whether any pay-outs were triggered in relation to China’s floods in 2023; if so, we can expect parametric schemes to expand further.

Italy’s Emilia-Romagna region, affected by flooding last year, is known for its agriculture sector. 5,000 farms were affected by the floods, including 400 million kilogrammes of wheat alongside fruit and other crops. European agriculture represents a growing market for parametric insurance, with most triggers based on rainfall or crop yield. Data provider Floodbase has designed solutions which use the proportion of an area which is flooded as the index—well suited for farms. To do this effectively, insurers need lots of accurate data; just last week, Floodbase announced a new satellite data partner.

In the US, MGA FloodFlash announced last month that they were removing minimum premium requirements in ten states. This makes parametric flood insurance accessible to even the smallest businesses that could not otherwise purchase the coverage they need. Meanwhile, modelling firms Fathom and Reask have collaborated to help companies add rainfall triggers to parametric tropical cyclone insurance. This should help protect companies against hurricanes that cause more damage from flooding than wind.

Whilst parametric insurance is still far from being widely adopted for floods, there are reasons to be optimistic. The growth of a parametric market for tropical cyclone and earthquake risks has been driven by years of organisations experiencing heavy losses, reliable data to use as an index and case studies of parametric paying out as expected. Recent developments represent a little more progress towards parametric flood insurance following suit.

Insuring interruptions in global supply chains

Supply chain • InsTech article

Supply chains have become longer, more international and more time-sensitive for decades, creating complex networks of dependency and risk. Our recent article looks at the parametric solutions helping companies manage risks in their supplier networks and disruptions in transit.

Getting ahead of the risk curve

UK • InsTech event

Turbulent times mean threats can arise faster than ever for risk managers. Our next evening event in London looks at the emerging technologies and new products risk managers are using. Generali will discuss how parametric solutions are filling protection gaps, while other speakers include the risk managers from Google, Portakabin and Landsec. Join us on 5 March from 4pm.

Latest parametric opportunities

Are you an insurer, MGA or broker with capacity to deploy for parametric insurance?

We know organisations seeking:

-

$50 million of insurance for wind speeds in Florida and the Gulf of Mexico, Mar-Dec 2024

-

$100 million of insurance for Philippines typhoon, Apr-Dec 2024

-

$10 million industry loss warranty for cyber catastrophes (PCS index) in excess of $2 billion, Apr-Dec 2024

Can you offer coverage to any of these organisations? Email [email protected] to learn more.

Do you represent an organisation looking for parametric insurance? The Parametric Post reaches parametric specialists across the global (re)insurance market. Reach out at [email protected] to talk about listing your need.

We are not a broker. InsTech, in partnership with ParaRisk (a joint initiative by 20 Twenty Search and Cerchia), makes paid introductions across the parametric insurance market, including brokers, (re)insurers, MGAs and data providers, to help facilitate transactions and grow the market for everyone.

In the news…

Floodbase and Capella work together on SAR data for flood

Flood • Satellite

Floodbase, which provides data for parametric flood insurance policies, has partnered with Capella to integrate synthetic aperture radar (SAR) data from satellites. Floodbase primarily uses optical satellite imagery, ground sensors and hydrological models (simulations of water flows) to measure flooding. Capella’s SAR sensors can ‘see’ through clouds and at night. This makes them a useful data source to validate flooding in conditions less suitable for optical imagery.

Reask and Fathom release tropical cyclone rainfall model

Cyclone • Flood

Modelling firms Reask and Fathom have collaborated on a new tropical cyclone rainfall model. It provides historical and live rainfall footprints for tropical cyclones worldwide and can be used to add a rainfall-related trigger to parametric wind insurance policies.

Arbol transacts derivative to hedge water price

US • Price risk

Parametric specialist firm Arbol has executed a call spread option relating to water price risk. A call spread option is a type of financial derivative transaction designed to protect an organisation against commodity price risks, similar to parametric insurance. In this case, a company has purchased parametric protection from Arbol against the price of water rising. The transaction used the NASDAQ Veles California Water Index NQH2O.

Case study: weather insurance for 29,000 farmers in India

India • Agriculture • Weather

The Swiss Re Foundation discusses the impact of a parametric weather insurance scheme it supported in India through the Swiss Capacity Building Facility (SCBF). The programme used technology from IBISA to cover 29,000 farmers in Gujurat and Odisha in 2023. Other SCBF members include Allianz, AXA, CelsiusPro and Zurich.

Descartes launches parametric solution for cyber shutdowns

France • Cyber

Insurer and MGA Descartes has launched an insurance product to protect small and medium-sized businesses in France against cyber attacks, focused on the manufacturing and retail sectors. The policy pays out a pre-agreed amount for each day a business is shut down by a ransomware attack, to compensate for loss of revenue and incident and response costs. Descartes says it aims to gain 5% share of the French cyber insurance market within 18 months. Descartes has more than 400 clients for its existing parametric climate and catastrophe insurance products.

FloodFlash removes minimum premiums in 10 US states

US • Flood

MGA FloodFlash, which offers parametric insurance triggered by sensor readings of flood depth, has expanded its coverage in the US. Since last year, FloodFlash policies have been available in every state, but now there is no minimum premium in Delaware, Iowa, Missouri, New Jersey, New York, Oregon, South Carolina, Washington, Vermont and Massachusetts. This suggests more small businesses are interested in parametric flood cover. FloodFlash has reduced its minimum premium in all other states to $25,000 USD.

Augment Risk brokers $400m hurricane deal for telecoms firm

Latin America • Hurricane

The Insurance Insider is reporting that start-up broker Augment Risk has arranged $400 million USD of parametric hurricane coverage for telecommunications company Liberty Latin America (LLA). LLA operates in more than 30 locations across Latin America.

Find out what you’ve missed…

Issue 63 – Parametric solutions for non-damage business interruption

Issue 62 – How parametric is filling wildfire protection gaps

Issue 61 – Why the parametric insurance market grew in 2023

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.