Traditional and renewable energy

The revenues of energy companies have always varied depending on weather conditions. In a warm winter, households and businesses use less energy to heat buildings. In a cool summer, less energy is used for air conditioning. In general, energy companies benefit from cold winters and warm summers and lose out from warm winters and cool summers, without experiencing any physical damage.

Since the 1990s, energy companies have smoothed out this weather-linked volatility in revenues by using weather derivatives. Weather derivatives are tradeable financial contracts that are used to hedge against weather risks. They are one of the earliest forms of parametric risk transfer, but, unlike parametric insurance, weather derivatives are not regulated insurance products.

THE PARAMETRIC POST: Warm winter triggers $12.9m pay-out to energy company (June 2023)

Star Group, an energy company operating in 19 US states, received a pay-out of $12.9 million USD from a weather derivative following warm weather in New York City in the first quarter of 2023. Energy companies such as Star Group use temperature derivatives to hedge against the risk of lower revenues from decreased energy usage in warm weather.

More recently, the transition to renewables has exposed energy companies to new risks associated with weather variability. Wind farms do not produce energy when there is insufficient wind. Solar farms similarly depend on the amount of solar irradiation (energy received from the sun) and hydropower plants on the flow of water through turbines.

Parametric solutions have been designed and sold for various renewable energy production risks. Sometimes the weather condition (wind, solar irradiation or water flow) is used as the index. If over a period of time, wind speeds repeatedly fall below a certain threshold, a wind farm operator can be compensated by its parametric policy.

Insurers have also been willing to use the power generated by a renewable energy plant as an index. For example, Swiss Re supported insurer Etiqa in launching a solar energy insurance product in Malaysia in 2023. Pay-outs are triggered if there has been both a drop in solar irradiation and a drop in the actual electricity output, as well as solar irradiation data. This ensures pay-outs only occur if solar irradiation (rather than operational or maintenance issues) causes low production. In the event of low solar irradiation, the solar farm operator is compensated exactly for its shortfall in energy production.

Swiss Re says this product was designed to promote investments in solar energy. If there is more certainty about the energy produced by a renewable energy plant, it should become more appealing to investors, thus supporting the energy transition. This concept also applies to households considering solar panels for their roof. Parametric solar irradiation solutions are being developed that would guarantee domestic solar panel owners a minimum level of energy production. This would make solar a more appealing investment to homeowners.

Wind and solar have been fast-growing areas for parametrics in recent years. Wind speed has a big impact on individual wind farm operators and also the regional utility grid. Solar plants are affected by variations in sunshine: how much solar irradiance is actually hitting the panels.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’

The impact of weather on the energy sector is complicated by the volatility of energy prices. Although insurers can underwrite the amount of energy produced by a hydropower plant, wind or solar farm, they are unlikely to guarantee its value, which fluctuates as prices change. Large energy companies purchase financial derivatives to manage price risk, but some risks remain where price and weather volatility intersect. Earlier this year, Munich Re was the first to underwrite a derivative on a new index for ‘shape risk’. We may yet see more forms of parametric risk transfer be developed to support the energy transition.

THE PARAMETRIC POST: Munich Re backs derivative using new wind energy index (October 2023)

Energy company Statkraft has entered into a parametric derivative transaction with Munich Re based on Speedwell Climate’s ‘Quality Factor’ index. Because wind farms generate power based on wind speed rather than demand, they are exposed to ‘shape risk’. This refers to the risk that renewable energy plants generate more power when the price of energy is low and less power when the price of energy is high, resulting in decreased revenue. This transaction, the first to use the quality factor index developed by Speedwell Climate and European Power Exchange (EPEX SPOT), enables Statkraft to hedge against shape risk for wind power in the UK.

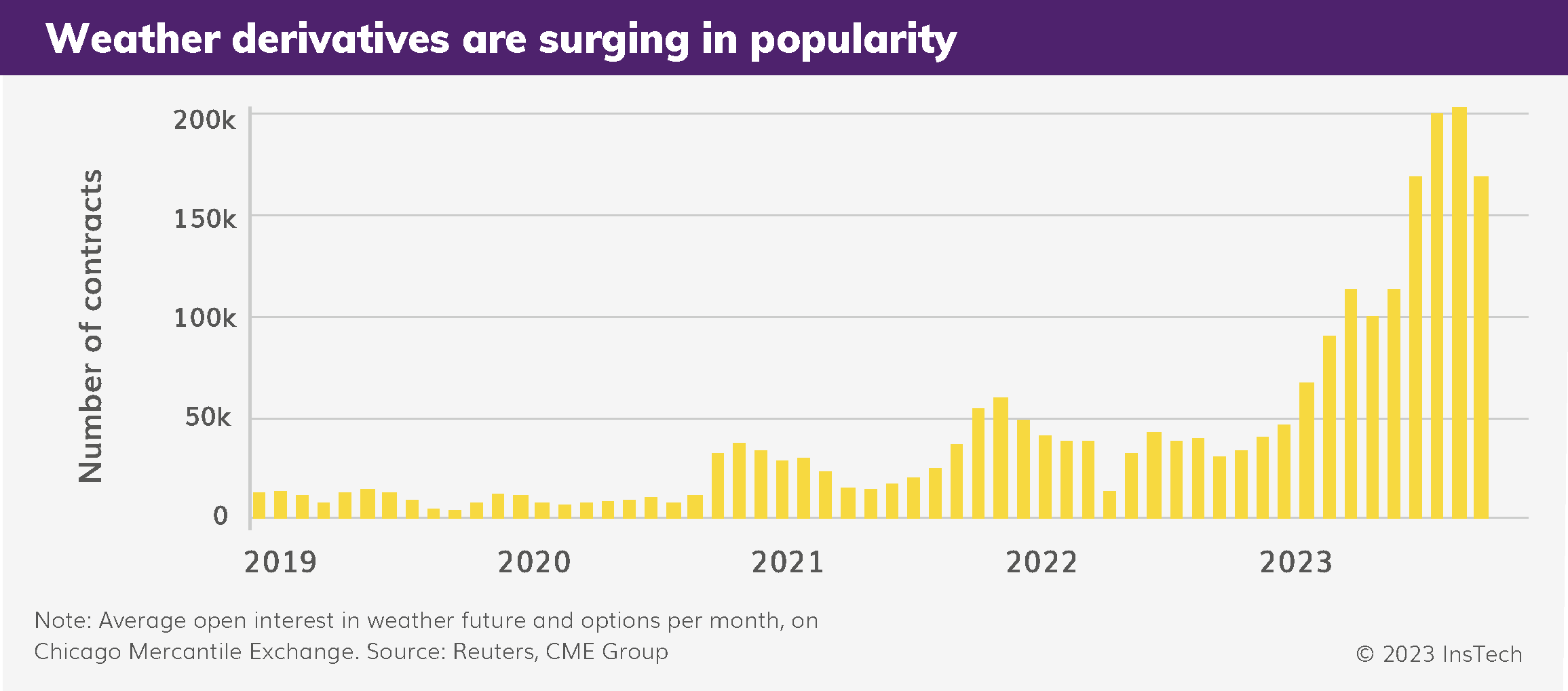

Overall, weather derivatives have seen a recent surge in popularity. Average open interest (a measure of the number of active contracts) at the Chicago Mercantile Exchange, one marketplace for these products, was twelve times higher in January to September 2023 than the same period in 2019. This excludes derivatives traded on other exchanges, those traded privately and parametric insurance contracts. This growth is driven in part by the energy industry, but also by other industries that depend on the weather for their demand or operations.

Other industries

The construction industry is a more recent adopter of parametric solutions for weather risk, especially in North America and Australia. Rainfall, snowfall or temperature conditions can prevent work from being carried out, for example where equipment or materials are sensitive to the weather. Project delays result in increased overhead costs or penalties for missed deadlines.

Several insurers are offering parametric weather coverage for construction companies. Collaboration with the construction sector is particularly important for structuring an effective product. Only part of a project may be weather-dependent and require parametric cover, but the project timelines can shift for various other reasons.

THE PARAMETRIC POST: Aviva Canada uses CelsiusPro platform for rainfall cover (March 2023)

Insurer Aviva Canada has launched a parametric excess rainfall insurance product, supported by parametric insurance technology company CelsiusPro. The product is designed for clients in construction, landscaping and municipalities. Aviva is using CelsiusPro’s White Label Platform, which covers underwriting, legal and claims, set up in French and English.

Weather also affects consumer behaviour. On dry, sunny days, people spend more of their time (and money) outdoors; indoor activities are more popular on wet or cold days. This is particularly relevant for event organisers and other businesses that depend on outdoor operations.

For example, one of Generali’s clients operates a high-value annual sporting event. This organisation relies on sales on the day at the event grounds to generate most of its revenue. The location is usually dry, but subject to occasional heavy rain, which would result in fewer visitors to the event. The organiser has purchased parametric insurance from Generali for the last four years; if it rains more than a certain threshold, the company receives a pay-out to cover the business interruption loss.

Other weather conditions also affect particular sectors in unique ways. The US ski industry and associated businesses (such as hotels near a ski slope) lose out on $1 billion USD in years with reduced snow. Snow removal organisations have used parametric coverage to protect them against winters where there is hardly any snow and consequently little demand for their services. Conversely, local authorities can purchase parametric policies to cover the large snow removal costs they face in snowy winters.

The agriculture sector is highly dependent on the weather and is one of the biggest purchasers of parametric insurance. Usually, this covers physical damage caused to crops by droughts, floods, heat, frost or other weather conditions (so outside the scope of this report). However, weather conditions can affect the food production of some livestock even if there is no physical damage to the animal. In different parts of Europe, parametric insurance products have been sold to cover the drop in cows’ milk production caused by high temperatures and the drop in bees’ honey production caused by low temperatures.

Download The Full Report

From the report ‘Intact but interrupted: parametric solutions for non-damage business interruption risks’