Climate Risk is InsTech’s monthly newsletter dedicated to climate-related insurance news – you can sign up for free here.

Property intelligence: understanding the “where” and “what” for climate risk

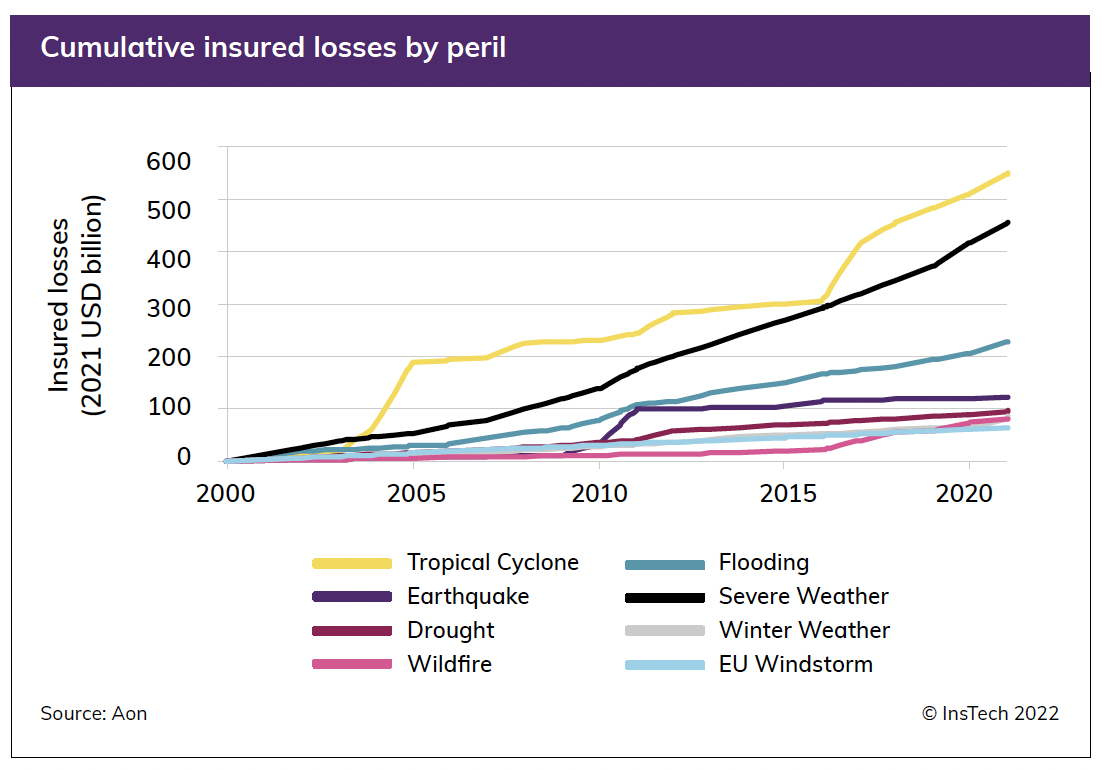

It is becoming more important than ever for insurers to understand what they are insuring and where it is located. 2022 has seen windstorms in Europe, floods affecting Australia and Hurricane Ian hitting the US.

As well as climate change increasing the frequency and severity of catastrophic weather events, demographic shifts are having an effect. More people are now living in hurricane paths and flood-prone areas, increasing the risk of insured losses.

Our next report, “Property Intelligence – the where and what: 50+ companies to know” focuses on the trends, technology and data available to help insurers understand where a property is located and what it is made of. More accurate and timely data can help improve risk selection, underwriting and pricing.

Coinciding with the launch of the report on 22nd November, Matthew Grant and Ali Smedley will be hosting a live digital event with Mark Varley, Founder & CEO at Addresscloud, Stu Cox, Senior Product Manager at Arturo and Todd Rissel, Chairman & CEO at e2Value. The discussion will cover the recent developments we’ve seen in the property intelligence market, how insurers are currently using property information and what data gaps still remain. You can register to attend here.

ESG reporting in 2023: Practical applications for managing and measuring carbon emissions

This event, supported by S&P Global Market Intelligence, continues our exploration of how insurers are measuring and managing climate-related risk. We will be joined by companies that are offering tools and data and the insurers that use them, including Swiss Re and Convex. We anticipate another lively and engaged discussion on stage and amongst attendees. Join us at CodeNode on Thursday, November 24th at 16:30 – you can register here.

In conversation with Richard Garry and Feargal O’Neill, Gamma Location Intelligence

Gamma Location Intelligence (Gamma LI) provides software and data services to help insurers better understand location risks in the UK, Ireland and Spain. Matthew Grant was joined by Richard Garry, Gamma LI’s Chief Commercial Officer, and CEO Feargal O’Neill for podcast episode 212. This article provides a summary of what was discussed, including the challenges of local address data in Ireland and the UK, ESG data for properties and how the company works with various partners for hazard data.

Article: Understanding and transferring climate risks

InsTech’s parametric insurance research lead Henry Gale attended the Weather Risk Management Association (WRMA) 2022 European Event in Paris. In this article, he shares two key takeaways from the event and explores what’s next for the parametric insurance market.

In the news…

Fathom launches new global flood hazard map

The new global flood map, Fathom-Global 3.0, includes inland fluvial, pluvial and coastal flood risk data. The map is at a 30-metre resolution globally and is based on terrain data from FABDEM, Fathom’s global digital elevation model with forests and buildings removed. Users of Fathom-Global 3.0 can quantify and mitigate flood risk, as well as understand changes in risk under future climate scenarios.

Marsh partners with Arsht-Rock to improve climate resilience

Marsh McLennan (MMC) will collaborate with Arsht-Rockefeller Foundation Resilience Center (Arsht-Rock) to increase the insurance industry’s involvement in the UN’s “Race to Resilience” programme. MMC will highlight disaster risk reduction initiatives that are moving communities from relying on recovery efforts to focusing on building resilience. Arsht-Rock works to develop policy, financial, technological and educational solutions to improve climate resilience for individuals and communities.

Previsico UK IoT flood solutions roll-out picks up speed

Previsico has announced that it is fast-tracking the roll-out of its Internet of Things (IoT) solutions and sensors across the UK. The company is now offering a “standalone service” for clients seeking to manage and mitigate flood losses. This follows successes in implementing these new solutions to locations at risk from flood, including Whalley, Lancashire, which flooded in 2015 and 2020. You can watch the case study video here.

JBA Risk Management launches global climate change tools

JBA’s new set of global climate change tools will allow the (re)insurance market, risk managers and lenders to understand future flood risk in any country. The suite of tools offers high-resolution probabilistic flood loss modelling and climate change analytics data, providing location-level baseline and future climate analysis of flood risk across the world. To learn more about JBA’s catastrophe models, flood maps and analytics, you can listen to InsTech’s podcast episode 206.

Aon acquires ERN to expand catastrophe modelling in Latin America

Catastrophe modeller ERN provides risk models for natural perils including hurricanes, earthquakes, storm surge, floods and tsunamis. The acquisition of ERN expands Aon’s catastrophe modelling suite by introducing earthquake and hurricane modelling for Latin America and the Caribbean. ERN will be joining Aon’s Reinsurance Solutions business, where it will collaborate with the Impact Forecasting team.

Pelt8 and AXA collaborate on SME emissions calculation tool

Pelt8 is creating a platform to help companies collect, aggregate and report on their sustainability data from within their organisation and across their stakeholders. Over 2022, the company has been working with AXA Switzerland to create “CO2-Quickcalculator”, a tool that allows Swiss SMEs get high-level insights into their current carbon emissions.

Verisk releases climate projections for US hurricane and Caribbean cyclone

Verisk’s climate change projections provide a probabilistic view of future risk for US hurricane and Caribbean cyclone in 2030, 2050, 2075 and 2100. These projections are available under four different Representative Concentration Pathway (RCP) scenarios. They will help insurers and reinsurers to assess future losses for residential, commercial, industrial, mobile homes and automobile lines of business.

McKenzie Intelligence Services (MIS) partners with Brush Claims

Claims solution provider Brush has partnered with MIS to improve claims response times following catastrophic events. MIS will provide Brush with real-time analysis of global perils that will be used alongside its suite of claims solutions, Hubvia. MIS’ insights will also enable Brush to predict damage when physical access to certain locations may be limited following a natural catastrophe. To learn more about MIS’ catastrophe response platform, you can read our recent interview with Rosina Smith and Daniel Grimwood-Bird.

Archipelago webinar: Understanding data’s role in successful ESG initiatives

On 16th November Archipelago’s CRO, Erroin Martin, and Director of Risk Engineering, Erin Ashley, explained the role that organising data plays in successful ESG initiatives. They also discussed how climate change is impacting ESG reporting through recent case studies.