The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… investors continue to back the parametric market

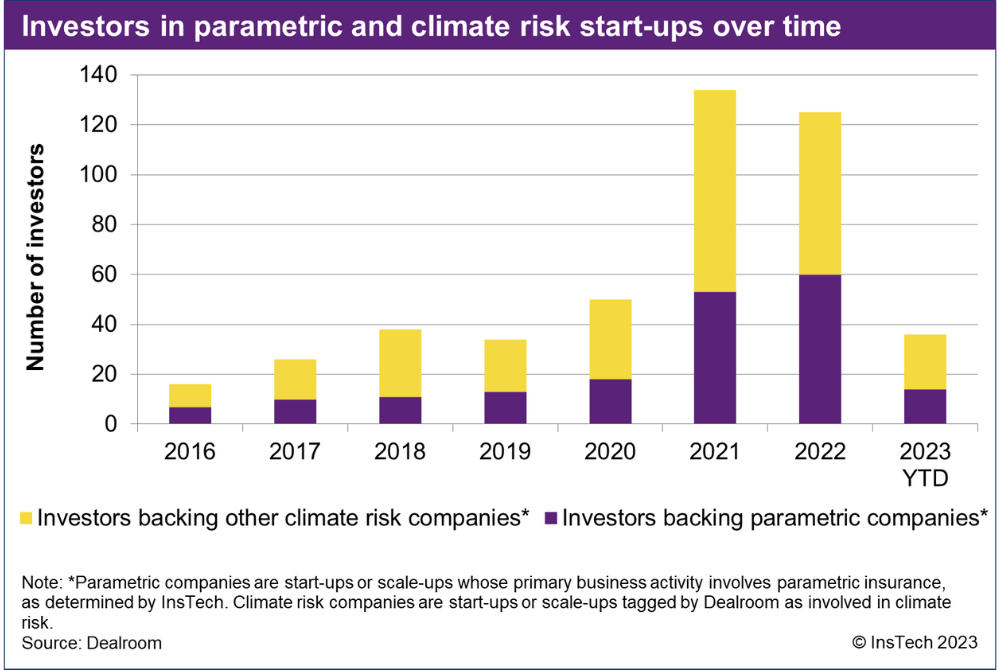

According to Dealroom, more than 150 organisations have invested to date in companies InsTech has identified that specialise in parametric insurance. Venture capitalists, private equity firms, accelerators, corporations, impact investors and governments have all supported the parametric insurance market. Some parametric investors specialise in insurance and risk, such as Anthemis Group, which has made five parametric investments, but many do not. More than a third never funded a company focused on parametric insurance or climate risk before 2022.

Although 2023 so far has seen fewer investments in parametric than 2021 and 2022, four recent examples involve investors that have never funded parametric or climate risk start-ups before, showing that the parametric market is continuing to attract new and varied investors.

Parametric start-ups Climatica and Riskwolf have each been selected for government-backed accelerator programmes. Climatica, specialising in weather coverage, is joining the first cohort of the European Union-backed BEYOND programme. BEYOND will invest €50,000 EUR in every company in the cohort that raises €150,000 EUR from external investors. Riskwolf has secured a 1.6 million CHF grant from the Swiss Innovation Agency, Innosuisse, as part of an accelerator programme where it plans to develop its parametric cloud downtime insurance product.

Two other companies relevant to parametric insurance also received investments in recent weeks. Mitiga Solutions, which creates risk models for wildfires, extreme weather and volcanoes, has raised €13.25 million EUR in a Series A round. Mitiga was the modelling agent for the first parametric catastrophe bond covering volcanic risk, supported by Howden Capital Markets, and its clients include WTW and AXA Climate. As well as venture capital investors, investment arms of Microsoft and insurer Nationwide participated in the round. Amini, which aims to solve the lack of environmental data in Africa, has raised $2 million USD in pre-seed funding. Amini provides drought, flood, soil and crop health data, which are being used for parametric agriculture insurance coverage.

If your company is an InsTech corporate member, you can contact Henry Gale on LinkedIn to find out the names of the 83 organisations that have invested in two or more parametric or climate risk companies. If you’re not a member and would like to learn more, contact us at [email protected].

In the news…

Arbol establishes collateralised insurer to access new capacity

Bermuda • Climate

Arbol, which underwrites parametric climate and weather insurance and derivatives, has set up a collateralised insurer in Bermuda, Arbol Re. This new structure will provide a new way for Arbol to connect companies seeking climate risk coverage with capacity. Arbol’s EVP & Chief Insurance Officer Hong Guo says Arbol Re will focus on parametric reinsurance deals backed by capacity from capital markets.

Whilst regulators require all insurance companies to hold a minimum amount of capital to pay claims, collateralised insurers must always hold the amount of capital they would need if the maximum claim was made on every policy – or their policies must be covered in full by reinsurance. Collateralised insurers like Arbol Re can reinsure every policy they underwrite, so the insurer does not retain any risk itself, rather acting as an intermediary between buyers of insurance and reinsurance capacity from reinsurers or capital markets.

Descartes: corporate insurance against tornado risk

US • Energy • Tornado

Tornadoes are becoming harder to insure, with traditional insurance policies subject to large deductibles and exclusions. Descartes Underwriting explains how it is protecting a Kentucky solar farm, hit by a tornado in 2020, with $100 million of parametric coverage for future tornadoes. Pay-outs are based on tornado intensity as measured by the Enhanced Fujita (EF) scale.

WTW: applications of parametric for mining companies

Earthquake • Cyclone • Weather

WTW’s Mining Risk Review 2023 includes an article from Julian Roberts, Managing Director, Risk & Analytics (Alternative Risk Transfer Solutions), discussing how parametric solutions can be used to manage catastrophic and weather risks for mining companies. Earthquakes, cyclones and excess rainfall can delay projects and increase costs when equipment is damaged, water in pits has to be removed or tailings dams collapse.

Aon: addressing climate uncertainty and emerging risks

North America • Weather • Earthquake

Aon has published four case studies of corporate clients purchasing parametric solutions. The case studies include hurricane cover for a manufacturer in Mexico, earthquake cover for real estate in Canada, tornado and weather cover for renewable energy construction in Texas and earthquake cover for a technology company in California.

CelsiusPro and university to use satellite data for parametric

Australia • Agriculture • Drought

Dr Jenny Wang, a research fellow at the University of Southern Queensland, has been awarded $431,000 AUD to lead a project focused on decreasing basis risk in parametric weather insurance for Australian farmers. The project, a collaboration with climate risk technology company CelsiusPro, will involve developing a machine learning algorithm to develop location-specific drought indicators from satellite imagery. The funding comes from an agency of the Australian government.

Flood risk transfer in data-scarce contexts

Colombia • Flood

A new report from the Insurance Development Forum (IDF) focuses on the challenges and opportunities of modelling and transferring flood risk in areas with limited data availability. The report includes a case study about an IDF project in Colombia, where farmers purchased a parametric flood insurance product developed by technology company Raincoat. Floodbase (then known as Cloud to Street) provided data to design the product and monitor flooding.

New York transport authority secures $100m parametric cover

US • Hurricane • Catastrophe bond

The New York Metropolitan Transportation Authority (MTA) has obtained $100 million USD of parametric storm surge coverage through a catastrophe bond. The MTA first purchased a parametric catastrophe bond after Hurricane Sandy caused billions in damage from storm surges in 2012. GC Securities is the structuring agent and CoreLogic is the calculation agent for the bond.

Dairy heat stress cover expands to UK with Markel capacity

UK • Agriculture • Weather

Rural insurer NFU Mutual is now offering parametric heat stress insurance, backed by capacity from Markel, to dairy farmers in the UK. Excessive heat causes reduced milk yield for dairy farmers. Skyline Partners structured the product, which it has offered in France since 2021 with SCOR and agriculture technology company ITK.

Global Parametrics announces 2022 impact and partnership

Climate • Flood

Global Parametrics has released its 2022 annual impact figures. 23 million beneficiaries across 55 countries were covered by its risk transfer programmes in 2022, 19 million of which are classified as poor and vulnerable. Many programmes Global Parametrics is involved in do not insure individuals directly but insure organisations such as community groups or aid agencies that pass on the benefits of any pay-out to individuals (the ‘beneficiaries’). Global Parametrics has also announced a new partnership with flood data provider ICEYE for parametric flood insurance.

AXA Climate extends Planet partnership for drought data

Drought

AXA Climate, part of the AXA Group specialising in parametric insurance, has extended its strategic partnership with satellite data provider Planet for drought insurance. AXA Climate uses Planet’s soil water content data to calculate a soil moisture index, which is used for parametric drought insurance.

Sensible Weather expands travel weather coverage to Europe

Europe • Travel • Weather

Sensible Weather, which provides parametric weather insurance embedded in travel bookings, has expanded its coverage from the US to Europe. It has partnered with outdoor vacation specialist Campsited to allow individuals booking European camping holidays through Campsited to be covered against bad weather on their trip.

Brokers partner on parametric rapeseed insurance in Europe

Europe • Agriculture • Drought

French broker Bessé has partnered with Austria-based broker GrECo for its parametric drought insurance product for rapeseed farms. Bessé developed the product with AXA Climate, covering the impact of dry summers on rapeseed germination, and it now covers almost 80,000 hectares in France. The partnership means that GrECo is the exclusive distributor of the product in Central and Eastern Europe.

Start Ready risk pool grows to £7.3m and purchases reinsurance

Africa • Asia • Humanitarian aid

Start Ready, a risk pool that uses parametric triggers to fund aid agencies when a climate shock is predicted, has entered its second year, with £7.3 million GBP of funding. Its policies for 2023-24 cover droughts, floods, cyclones and heatwaves in the Democratic Republic of the Congo, Somalia, Pakistan, Philippines, Bangladesh, Madagascar and Senegal. For the first time, the Start Ready risk pool has purchased reinsurance, protecting it against running out of funds if many pay-outs are triggered. Start Ready was set up at COP26 in 2021.

Find out what you’ve missed…

Issue 48 – Parametric insurance for marine ecosystems

Issue 47 – Who cares about parametric insurance?

Issue 46 – Parametric solutions for corporate earthquake risk

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.