Climate Risk is InsTech’s monthly newsletter dedicated to climate-related insurance news – you can sign up for free here.

Climate risk: what data gaps remain?

At InsTech, we are always speaking to insurers, brokers and MGAs about what they’re interested in, what their challenges are and what solutions they’re looking for. We have noticed a growing interest in data and models for “secondary perils” and previously “non-modelled perils” including freeze, extreme rainfall and lightning. Companies are releasing new data sets and models, but gaps remain for many geographies and perils.

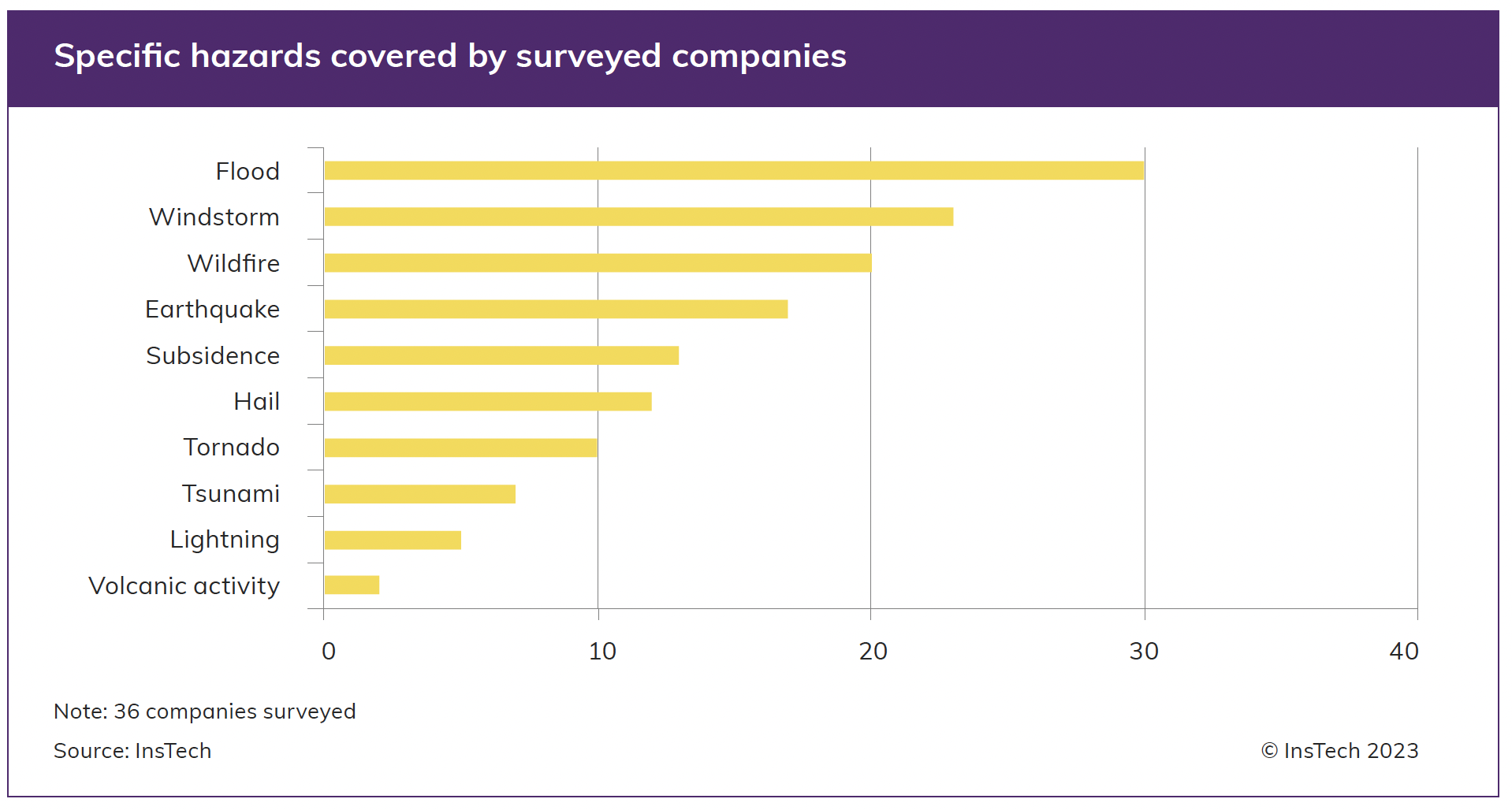

InsTech’s latest report, “Property Intelligence: Understanding and managing natural hazards” features 36 companies offering solutions relating to natural hazards, including catastrophe modellers and hazard score providers. We also include perspectives from an insurer, broker and MGA on the current hazard data and catastrophe modelling market and what they are looking for from these providers. The report can now be downloaded for free here.

Our digital launch event featuring speakers from EigenRisk, Gamma Location Intelligence and JBA Risk Management is also now available to watch on demand.

JBA Risk Management: the complexities of understanding future flood risk

InsTech’s Ali Smedley joined JBA’s Hydrology Technical Lead, Dr Dave Leedal, to discuss how snowmelt-induced flooding is affected by climate change, how JBA is helping insurers understand future flood risk and what the company’s plans are for 2023.

The Demex Group: Insuring the gap – protection for frequent weather losses

The Demex Group’s President & CEO Bill Clark and Chief Risk Officer Matt Coleman recently joined Matthew Grant and Henry Gale on InsTech podcast episode 234 to talk about how increasing losses from non-catastrophic weather events leave enterprises and insurers exposed. A summary of the key points of the discussion is also now available to download here.

Descartes Underwriting and Previsico: using IoT to manage and transfer commercial flood risks

Descartes Underwriting’s Paul Jones and Previsico’s Dr Andrew Pledger recently joined InsTech’s Henry Gale to discuss how flood risk affects commercial properties, how to manage this risk with forecasting and sensor technologies and the use of parametric insurance.

Nearmap: Property in three dimensions

Matthew Grant was joined by Tony Agresta, EVP and General Manager of North America, and Dr Michael Bewley, VP of AI and Computer Vision at Nearmap, for podcast episode 236. They discuss the differences between aerial imagery from aircraft compared to satellites, creating 3D images of properties and how Nearmap works with partners.

Geosite: Your gateway to global geospatial data

Geosite’s software is used for a wide range of activities, from speeding up search and rescue operations to improving insurance underwriting and claims processes. Matthew Grant was recently joined by Rachel Olney, Founder and CEO, to discuss why she founded the company, how it helps insurers and why “accuracy” means different things when identifying building locations depending on the hazard.

Cerchia: new sources of capital to transfer emerging risks

Cerchia is creating a digital marketplace to build a bridge between capital market investors and buyers of protection. InsTech’s Henry Gale spoke to Michael Rey, CEO and Co-founder, and Fabian Buchmann, COO and Co-founder, about emerging risks for communities and businesses and how to use innovative financial structures and parametric triggers to enable sustainability investments.

Property Intelligence Breakfast – HazardHub from Guidewire – plugging your property data gaps

If you are underwriting or analysing property risk, you know the importance of having accurate hazard data within your workflow. HazardHub, now part of Guidewire, offers over 1,400 risk factors providing a comprehensive view of what could go wrong at any chosen property in America. At this members-only event, you will be able to join Founder Bob Frady on 19 April, 8.30am BST at The Ivy City Garden to gain a better understanding of risk profiles to optimise portfolio performance. Click above to register your interest.

In the news…

Cytora and Addresscloud partner for commercial property insights

Cytora’s customers now have access to Addresscloud’s address matching and geocoding API, giving them a rooftop-level view of commercial property risks and accurate real-time flood scores. Cytora will also benefit from Addresscloud’s range of property data as part of its data enrichment approach. To learn more about how Cytora’s solution assists underwriters, you can listen to InsTech’s recent podcast with Richard Hartley, Co-founder and CEO.

Lloyd’s Lab selects its Cohort 10 teams

13 teams have been selected to take part in the latest cohort, of which climate and new products supporting green technologies were key themes. Companies selected include FireBreak which focuses on wildfire risk, flood modelling company REOR20, Value.Space which provides satellite-based risk assessments, Intelligent AI which offers a solution for commercial property underwriting and PolArctic, which is identifying and creating solutions to business and policy questions about the Arctic.

Chubb announces climate underwriting standards for oil and gas

Chubb has announced new underwriting criteria for oil and gas extraction projects that will require clients to reduce methane emissions, which is one of the most severe greenhouse gases. The company has also announced that it will not provide insurance coverage for oil and gas projects in government-protected conservation areas.

African Risk Capacity to provide disaster risk insurance in Djibouti

The Government of Djibouti has signed a multi-year agreement with the African Risk Capacity Group (ARC) Group to protect the country’s most climate-vulnerable communities. Descartes Underwriting has provided its modelling capabilities to design and support the risk transfer of the customised multi-peril cover.

Mozambique secures $35m cyclone parametric insurance

The Mozambique Government has secured $35 million USD of parametric cyclone insurance via the National Institute of Disaster Management, supported by Africa Specialty Risks, the World Bank and Pula. CelsiusPro has acted as the calculation agent, modelling the risk and working on the product design.

LightBox launches US zoning data product

The zoning data provides customers with a standardised source for parcel-level zoning data across the US. Detailed information on zoning requirements, setbacks, density and building height, among other areas, are available across jurisdictions, enabling customers to search, filter and analyse properties across geographies.

Maptycs adds Steve Hearn to its board of advisors

Maptycs provides a geospatial risk visualisation platform for property insurers, reinsurers, brokers and risk managers. Steve Hearn, CEO at Inver Re, has recently joined Dawn Miller and Mark Breading on the company’s board of advisors. To learn more about Maptycs, you can read our recent interview with CEO and Co-founder Jacqueline Legrand.

Oasis LMF and Lloyd’s Market Association – London event

On 3rd and 4th May, Oasis LMF and LMA are hosting an event in London to discuss catastrophe modelling, climate change and open data standards. There will be speakers from a range of InsTech members including Fathom, JBA Risk Management, Aon, CoreLogic, Chaucer and reThought Insurance.