The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… building momentum for parametric flood insurance

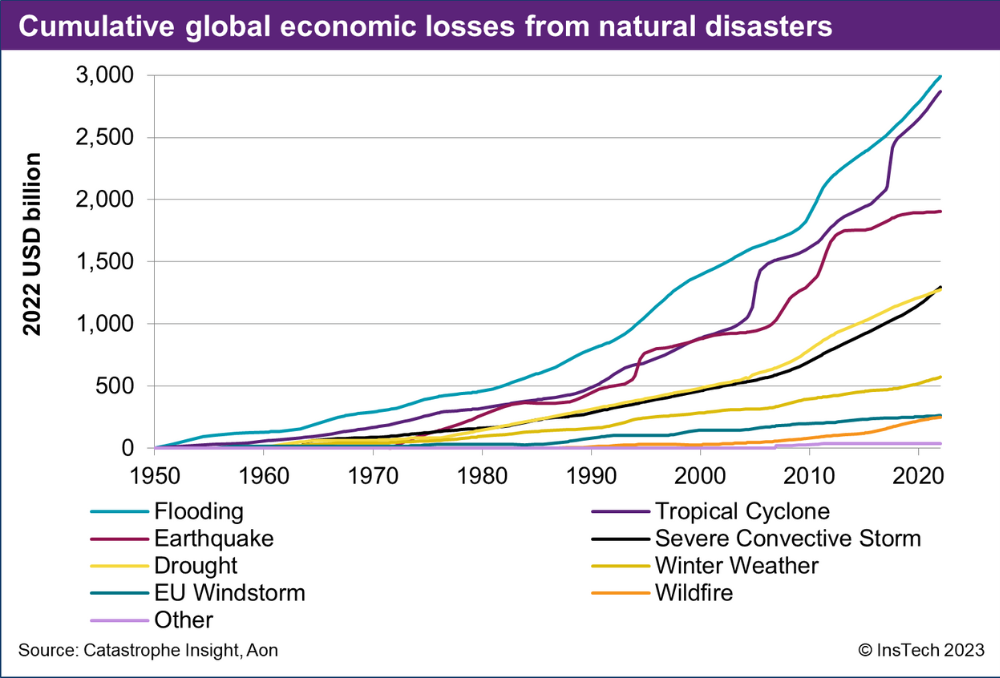

Flood is one of the most pervasive global perils. According to Aon’s 2023 Weather, Climate and Catastrophe Insight report, flooding events have caused nearly $3 trillion USD in total economic losses since 1950, with losses from tropical cyclones including associated flooding a close second. Flood remains severely underinsured, with less than 20% of the $66 billion USD in economic losses from flooding events in 2022 covered by insurance.

As climate change causes flood risk to increase, making traditional insurance coverage yet more challenging, parametric insurance has a role to play in helping communities, businesses and governments recover from floods quickly. Challenges with setting the right trigger mean that parametric flood insurance has not been as widely offered or adopted as parametric solutions for other natural perils such as hurricanes or earthquakes. Different technologies and data sources are needed to design parametric policies to cover varied flood exposures.

This week’s Parametric Post includes case studies of new approaches to parametric flood insurance enabled by technologies including sensors and satellite imagery. Descartes Underwriting and Previsico discuss, in a joint interview, how they are using sensors for commercial parametric flood insurance in the UK and Ireland. FloodFlash announces its insurance capacity as it expands its sensor-triggered flood insurance product to the US. Swiss Re and Guy Carpenter back a new parametric scheme using satellite imagery to support communities in New York City with high flood risk.

Insuring the gap: protection for frequent weather losses

Climate • InsTech podcast

On InsTech podcast episode 234, The Demex Group’s Bill Clark and Matt Coleman discuss the impact of climate change on weather risks frequently retained by insurers and corporates and how to structure parametric solutions tailored to an organisation’s specific weather exposure.

Using IoT to manage and transfer commercial flood risks

UK • Flood • InsTech interview

Descartes Underwriting’s Paul Jones and Previsico’s Dr Andrew Pledger discuss how to manage and transfer flood risk with forecasting, sensor technologies and parametric insurance. Descartes Underwriting’s parametric flood insurance in the UK and Ireland uses Previsico sensors, public gauges or other sensor technology to execute the index.

Blink Parametric: transforming the travel claims experience

Travel • InsTech interview

Carl Carter, Chief Commercial Officer at Blink Parametric, discusses how COVID-19 and climate change have left travel insurers struggling with claims surges and how parametric solutions are helping claimants and insurers. The interview includes research on customer demand for parametric travel solutions and the impact of parametric policies on travel insurers and brands that offer them.

In the news…

Aviva Canada uses CelsiusPro platform for rainfall cover

Canada • Weather • Construction

Insurer Aviva Canada has launched a parametric excess rainfall insurance product, supported by parametric insurance technology company CelsiusPro. The product is designed for clients in construction, landscaping and municipalities. Aviva is using CelsiusPro’s White Label Platform, which covers underwriting, legal and claims, set up in French and English.

Swiss Re-backed parametric flood pilot launches in New York

US • Flood

A pilot parametric risk transfer project has been launched to support low- and moderate-income (LMI) communities in high-flood-risk areas of New York City. Swiss Re is providing a parametric flood derivative to the Center for New York City Neighborhoods (CNYCN). If the derivative is triggered, CNYCN uses the pay-out to provide emergency cash grants to eligible New Yorkers. Other partners on the project include Guy Carpenter, satellite data provider ICEYE, the Environmental Defense Fund (EDF), SBP USA and the New York City Mayor’s Office of Climate & Environmental Justice. Look out for our upcoming podcast episode with EDF’s Carolyn Kousky, who was involved in developing this project, discussing parametric cover and community-based catastrophe insurance.

New Paradigm launches subsidiary for hybrid parametrics

US • Energy

MGA New Paradigm Underwriters, which provides natural catastrophe parametric insurance in the US, is planning to launch a subsidiary, Conductive Underwriters. Conductive Underwriters will provide insurance policies that include indemnity-based and parametric aspects for niche business classes including renewables and industrial risks.

Descartes construction cover: excess rain and climate risks

Weather • Construction

Adverse weather affects 45% of construction projects globally, according to insurer and MGA Descartes Underwriting, resulting in billions of dollars in additional expenses and lost revenue. Descartes’ case study shows how parametric policies can be structured to meet a construction project’s exposures.

Swiss Re earthquake cover for renewable energy project

Nepal • Earthquake • Energy

After the 2015 Nepal earthquake, traditional insurers were reluctant to provide coverage for a large hydropower project in Nepal. Swiss Re Corporate Solutions and Aon structured a parametric earthquake insurance policy covering the five-year construction period, enabling the project to progress. The parametric trigger is based on earthquake intensity at the project site as measured by the US Geological Survey.

Vortex announces parametric hurricane product

US • Hurricane

Vortex Insurance Agency, a subsidiary of MSI GuaranteedWeather (owned by insurer Mitsui Sumitomo), has announced a parametric hurricane insurance product for businesses in the US. The policy is triggered by Category 3 or above hurricanes passing within a radius around the policyholder’s location. Companies will be able to purchase the product through an online portal.

Somalia drought triggers $4.2m in parametric pay-outs

Somalia • Drought

After two parametric policies were triggered, humanitarian agency group Start Network will disburse $4.2 million USD in aid in Somalia. Start Network had a parametric drought policy with the African Risk Capacity (ARC), which paid out $3.38 million USD, while Start Ready, a parametric risk pool set up at COP26, is paying out £700,000 GBP. The Somali Disaster Management Agency also confirmed that the government of Somalia is purchasing parametric drought insurance from ARC for the March to June 2023 rainfall season.

Munich Re extends capacity partnership with FloodFlash

US • Flood • Sensors

MGA FloodFlash, which provides commercial parametric flood insurance using sensors, has extended its partnership with Munich Re Syndicate at Lloyd’s. Munich Re, which already provides capacity for FloodFlash in the UK and invested in its Series A funding round, will provide capacity for FloodFlash’s policies in the US. FloodFlash launched in the US in 2022, offering policies in Florida, Virginia, Texas, Louisiana and California.

Parametric product for beekeepers covers honey losses

Italy • Agriculture • Weather

Italian insurer Revo Insurance has launched a parametric insurance product covering beekeepers against loss of honey production caused by temperature drops. The product was designed in partnership with broker Pulsar Risk and beekeeping association Aspromiele. REVO-SPAC, a special-purpose acquisition company focused on parametric insurance, acquired Italian insurer Elba Assicurazioni in 2021 and became Revo Insurance.

Find out what you’ve missed…

Issue 43 – Covering business interruption losses with parametric insurance

Issue 42 – Parametric protection for gig workers

Issue 41 – Growing broker involvement in parametric

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.