Climate Risk is InsTech’s monthly newsletter dedicated to climate-related insurance news – you can sign up for free here.

2022 losses highlight the importance of secondary climate perils

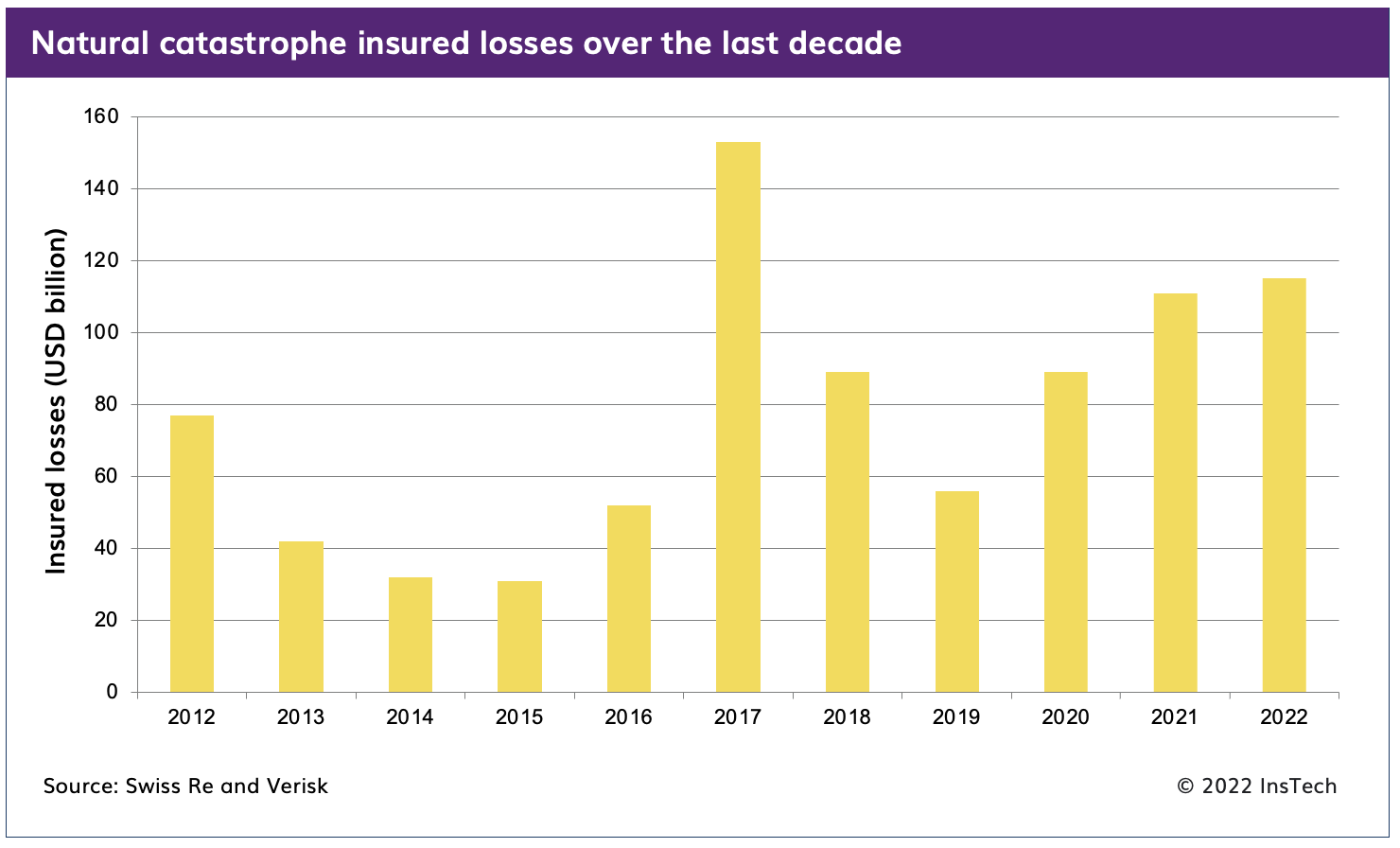

2022 has been another big year for natural catastrophe event losses. According to Swiss Re, it is set to be the second consecutive year in which the estimated insured losses total more than $100 billion USD.

Whilst Hurricane Ian has been the single largest loss-causing event of the year, a range of secondary perils have also contributed to overall losses. Secondary perils generate small to mid-sized losses, take place due to another event or are less widely modelled. These perils include hail, flood, storm and wildfire.

Torrential rains this year led to widespread flooding in Australia, causing estimated losses of $4 billion USD – making it the country’s costliest-ever natural catastrophe. This year also saw numerous thunderstorms in the US and the most severe series of hailstorms France has experienced on record.

From InsTech’s conversations with insurers, we are observing an increasing interest in data and models to help understand the risk from secondary perils. With climate change increasing the frequency and severity of these types of weather events, we expect to see interest in this area grow over the next year.

Climate Risk will be back in January 2023 to cover the latest news and developments within the climate, property risk and ESG space. Are there any topics you would like to see us cover over the next year?

Property Intelligence – the where and what: 50+ companies to know

In 2021, we released our first report on location intelligence, covering location data, property attribute information, catastrophe modelling and remote claims assessment. Our next report focuses only on the “where” and “what” of property intelligence – understanding where a property is located and what it is made of to help insurers improve risk selection, underwriting and pricing. The report is now available to download for free.

Tropical Cyclone – Managing Tomorrow’s Climate Risk Today with Reask and Fathom

In this episode, we cover the highlights from our recent live event in London. We heard about how insurers and portfolio managers are taking account of the increased need to understand the combined risk of floods and hurricanes. We were joined by some of the organisations helping to provide climate analytics and data including Fathom, Reask and the Oasis Loss Modelling Framework.

McKenzie Intelligence Services & Brush Claims: The partners improving post claims loss assessment

Matthew Grant and Ali Smedley were joined by Daniel Grimwood-Bird from McKenzie Intelligence Services (MIS) and Troy Stewart from Brush Claims for podcast episode 219. They discuss how the companies work together and their plans for a combined response to future catastrophe events. Listen to the full episode to discover how MIS prepared for Hurricane Ian, Troy’s experience in the Lloyd’s Lab and more.

Geosite: enabling geospatial intelligence

Geosite’s software is used for a range of activities, from speeding up search and rescue operations to improving insurance underwriting and claims processes. Ali Smedley caught up with Rachel Olney, Founder and CEO, about the genesis of Geosite, how it partners with third-party data providers and how the company supports industries outside of insurance.

Tensorflight: Property characteristics – new data for new challenges

Tensorflight uses AI, aerial and street view imagery to provide data and risk analytics on commercial, personal and industrial properties globally. Matthew Grant was joined by Jacob Grob, Chief Revenue Officer at Tensorflight, to discuss his personal experience with Hurricane Ian and some of the latest developments in providing property data.

Parametric initiatives at COP27: what you need to know

Financial support for the poorest countries most affected by climate change was a key theme of COP27. In this article, Henry Gale explores the six key announcements that were made at the conference which establish or expand parametric insurance projects protecting vulnerable communities against climate events.

The Demex Group: tackling the challenges of severe thunderstorm risk

The Demex Group offers solutions for modelling, assessing and transferring climate-related risks. In this interview, Henry Gale speaks to Matt Coleman, Chief Risk Officer at Demex, about closing the severe thunderstorm insurance protection gap, modelling climate risks and parametric reinsurance.

In the news…

Descartes launches ‘full-stack’ insurance company

Descartes Underwriting, the Paris-based MGA which sells parametric insurance for climate-related risks, has received a licence to underwrite risk against its own balance sheet as Descartes Insurance. The company can now issue policies directly to mid-market clients in France, with plans to expand to other countries in the European Economic Area over 2023.

JBA and Cytora partner on commercial property flood risk

Through the partnership, insurers will now be able to automatically embed JBA Risk Management’s data and analytics within the Cytora underwriting platform. This will allow commercial property underwriters to make more informed decisions in relation to flood risk. To learn more about JBA’s catastrophe models, flood maps and analytics, you can listen to InsTech’s podcast episode 206.

Ardonagh Specialty to use RMS flood and wildfire models

London-based broker Ardonagh Specialty has signed a new agreement with RMS to expand its US flood and wildlife capabilities. The partnership will see the company broaden its adoption of the RMS Intelligent Risk Platform™ and advance its modelling and advisory capabilities using the RMS US Inland Flood HD Model and the RMS US Wildfire HD Model.

Howden: higher ESG ratings correlate to lower loss ratios

According to a joint study by broker Howden and specialty (re)insurer Fidelis, higher ESG ratings lead to better underwriting performance. The report examined loss ratios across 30,000 policies, matching them to third-party ESG ratings. It found that environmental ratings have the strongest correlation with loss ratios and that property insurance showed the strongest correlation out of all business lines.

CSAA partners with ZestyAI for wildfire risk assessment

To help understand property-level wildfire risk, CSAA plans to integrate ZestyAI’s Z-FIRE™ product offering into underwriting and rating processes for homeowners’ insurance. Kumar Dhuvur, Co-founder and Head of Product at ZestyAI, joined Matthew on InsTech podcast episode 190 to discuss the data sources the company uses to build risk models and the benefits of assessing risk on the property level.

Gamma Location Intelligence collaborates with MGAM on UK public sector deal

Gamma LI is helping to support the government-backed professional indemnity scheme rolled out by MGAM, which provides the cover for external wall system (EWS1) fire review certificate assessors. Gamma LI has developed a platform to better manage, access and share data regarding fire assessments.

ICEYE and Betterview partner for catastrophe response

Data from ICEYE will now be available to all Betterview users within PartnerHub, the third-party marketplace within its Property Intelligence & Risk Management Platform. By combining ICEYE’s SAR imagery with additional insights on the Betterview platform, such as first-floor elevation, insurers can identify properties with flood damage faster than physical inspection teams.

Arbol makes $10m USD pay-out to insurer after Hurricane Ian

Arbol, which underwrites parametric reinsurance through its Bermuda-based MGA, has made a pay-out to Centauri Insurance less than three weeks after Hurricane Ian made landfall. The product is triggered based on predefined wind speeds at each property in a portfolio. To learn more about Arbol, you can listen to InsTech’s interview with Founder and CEO Sid Jha on podcast episode 208.

Maptycs adds Mark Breading and Dawn Miller as company board members

Maptycs provides a geospatial risk visualisation solution for property insurers, reinsurers, brokers and risk managers. The company’s new advisory board members will apply their industry expertise to advise on Maptycs’ expansion across the US and Europe.

CelsiusPro: how to back climate action and reporting with appropriate governance and incentives

In collaboration with consulting firm HCM International, CelsiusPro has authored a whitepaper covering how companies exposed to climate-related risks will need to set up governance structures and targets. The paper explores the disclosure framework that the Task Force on Climate-related Financial Disclosures (TCFD) has created and how it can be used for internal decision-making.

KCC launches climate-conditioned catalogues for hurricanes, floods and wildfires

Karen Clark & Company (KCC) has launched stochastic climate-conditioned catalogues for the weather-related perils most impacted by climate change: hurricanes, floods and wildfires. The catalogues represent each peril’s climate projections out to 2025, 2030 and 2050. There are also three different views for the 2050 catalogues that reflect a range of emissions scenarios provided by the Intergovernmental Panel on Climate Change (IPCC).