The Parametric Post, the only newsletter dedicated to parametric insurance.

You can sign up for free here.

The InsTech perspective… 2022: already a record year for parametric insurance funding

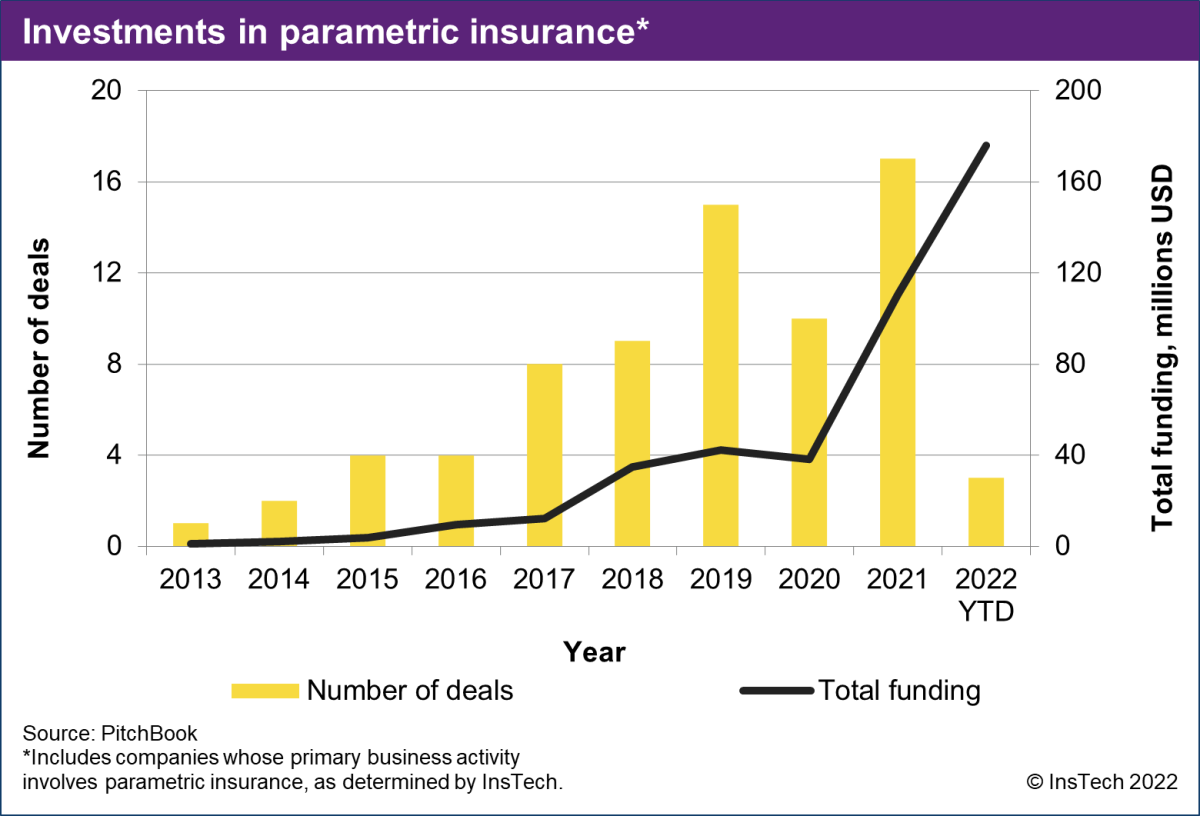

Much of parametric insurance innovation is driven by start-ups and scale-ups partnering with industry incumbents. While we haven’t been able to verify any figures for the overall parametric insurance market size yet, the funds raised by these newer companies is a proxy for how parametric insurance has grown in scale in recent years.

Data from PitchBook shows companies specialising in parametric insurance raised more than $110 million across 17 deals in 2021, more than any previous year. Descartes Underwriting’s $120 million Series B raise in January makes 2022 already a record year for parametric insurance funding. We know a number of parametric-focussed companies that are or will be looking to raise funds this year too.

There are three observable trends. First, the number of funding rounds has increased steadily, despite a drop in 2020. We are seeing a continuing stream of new entries into the parametric insurance market. Second, the rise in total funding accelerated in 2021 and will continue into 2022, indicating investor confidence in parametric. Third, the average funding per deal is also increasing, driven by bigger, later-stage rounds from earlier entrants which are now scaling up.

InsTech podcast episode 176 features Ruth Foxe Blader and Matthew Jones from venture capital investor Anthemis discussing the current state of investment in insurance innovation. Ruth and Matthew explain why Anthemis invested in Stable, a company providing parametric insurance for commodity price risk.

Company spotlight: Descartes Underwriting

UK • Climate • InsTech interview

Parametric insurance MGA Descartes Underwriting’s London team discusses the company’s recent funding, global expansion and trends in parametric insurance. Descartes Underwriting is an MGA providing parametric catastrophe and weather insurance solutions to corporate clients.

Company spotlight: Chainlink Labs

Blockchain • InsTech interview

Chainlink Labs’ William Herkelrath discusses the use of blockchain in parametric insurance, explaining the concepts which underpin blockchain-based insurance and how Chainlink oracle networks can provide data to smart contracts to trigger parametric pay-outs. Arbol, Etherisc, OTONOMI and Ensuro use Chainlink oracle networks for their parametric insurance applications.

In the news…

Arbol transacted $70m gross premium in 2021

US • Weather • Blockchain

Arbol, which provides parametric solutions for weather risk using blockchain technology, says it transacted $70 million in gross premium in 2021. Gross premium is the sum of all premiums paid by clients, including commissions paid to brokers. Founder and CEO Sid Jha said that more than half of Arbol’s clients were purchasing weather risk solutions for the first time. Arbol launched in March 2020 and transacted $2.2 million in gross premium in 2020.

Swiss Re partners with Brazil meteorological agency

Brazil • Weather

Swiss Re Corporate Solutions has partnered with INMET, Brazil’s National Institute of Meteorology. INMET will provide weather data for Swiss Re’s parametric insurance policies. INMET says it is “launch[ing] itself as a provider of parametric index data” with the Swiss Re partnership and suggests it is open to working with more insurance companies on parametric insurance.

Descartes Underwriting partners with Reask

Tropical cyclone • InsTech podcast

Descartes Underwriting has announced its partnership with tropical cyclone risk analytics firm Reask. Descartes will use Reask’s calculation agent product Metryc to provide wind speed data for parametric tropical cyclone policies. Swiss Re Corporate Solutions is also using Metryc for parametric tropical cyclone insurance. We interviewed Reask’s co-founders Nick Hassam and Thomas Loridan on InsTech podcast episode 127.

$10.7m pay-out to Madagascar triggered by Cyclone Batsirai

Madagascar • Cyclone

Cyclone Batsirai, which made landfall in Madagascar on 5 February 2022, triggered a $10.7 million pay-out, paid on 1 March, to the government of Madagascar under its tropical cyclone insurance policy with the African Risk Capacity (ARC), a multi-country risk pool. This is thought to be ARC’s first tropical cyclone pay-out. Pay-outs are calculated by a risk model that takes into account the characteristics of the cyclone and the vulnerability and exposure of the area affected. 19,000 homes were damaged by Cyclone Batsirai according to the Malagasy Disaster Management Agency.

Embedded flight disruption cover launched in France

France • Travel • InsTech article

Broker Koala has launched its parametric flight disruption insurance product in France with airline ASL Airlines France. Travellers booking flights on the airline’s website will be able to buy cover against delays and cancellations at the point of purchase. Policies are backed by insurers Wakam and Seyna, and reinsured by Swiss Re. You can learn more about Wakam’s embedded travel disruption policies in our article from 2021.

Area yield index insurance launched for rice farmers in Nigeria

Nigeria • Weather • Agriculture

Nonprofit Heifer International has worked with start-up Pula, agribusiness Olam and insurer Leadway Assurance Company to launch an area yield index insurance product for rice farmers in Nigeria. Area yield index insurance protects farmers against reduced yield by measuring a geographical area’s average yield for a season against previous seasons. Pay-outs are triggered if the reduction in yield exceeds a predefined threshold.

Find out what you’ve missed…

Issue 19 – The flood protection gap and parametric insurance

Issue 18 – What’s holding parametric insurance back?

Issue 17 – Parametric pay-outs from Typhoon Rai

Sign up here to receive the latest news, stories and insights on parametric insurance every two weeks.